How Strong Is the Market? A Local Look at Belmont, San Carlos & San Mateo County

Belmont– Local Market

- Belmont is still a seller’s market, but pricing accuracy matters more than it did last year.

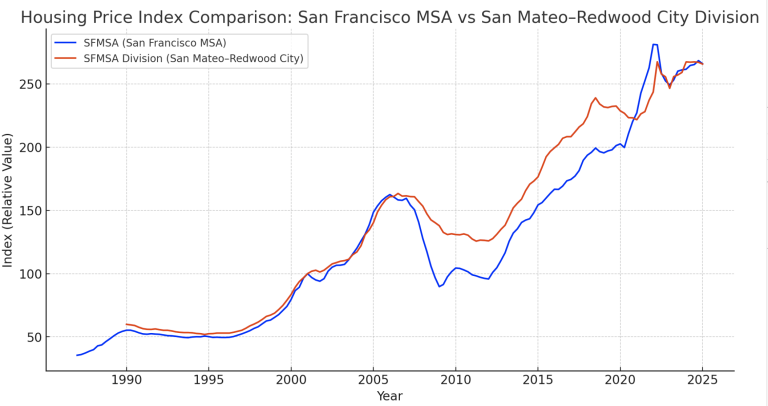

- CAGR: ~4.3% annually (Compound Annual Growth Rate)

Policy Watch: Capital Gains, Mortgage Rates, and Housing Momentum

Donald Trump has expressed support for eliminating the federal capital gains tax on the sale of primary residences, calling it a potential incentive that could help homeowners access equity and increase housing market turnover. His comments followed the introduction of legislation by Marjorie Taylor Greene, titled the No Tax on Home Sales Act, which would remove the tax entirely for owner-occupied homes…

Two Powerful Marketing Strategies-which one is right for your home?

Off-Market vs. MLS Listings: What’s Better for Bay Area Sellers?

In the competitive Bay Area real estate market, the way you bring your home to market can make all the difference—not just in how quickly it sells, but in how much it sells for. One of the most common questions we hear from sellers is:

“Should I list my home on the MLS or explore an off-market strategy?”

California’s AI Windfall Is Becoming Hard To Live Without—That Could Spell Trouble for the Housing Market

California’s AI windfall is showing up in two very important places for residents: the housing market and the state’s balance sheet.

As AI-fueled gains have kept money flowing through the tech sector, they’ve propped up high-end home demand in tech centers like San Francisco while helping Sacramento plug a nearly $18 billion budget deficit.

How Strong Is the Market? A Local Look at Belmont, San Carlos & San Mateo County

Belmont– Local Market

- Belmont is still a seller’s market, but pricing accuracy matters more than it did last year.

- CAGR: ~4.3% annually (Compound Annual Growth Rate)

Policy Watch: Capital Gains, Mortgage Rates, and Housing Momentum

Donald Trump has expressed support for eliminating the federal capital gains tax on the sale of primary residences, calling it a potential incentive that could help homeowners access equity and increase housing market turnover. His comments followed the introduction of legislation by Marjorie Taylor Greene, titled the No Tax on Home Sales Act, which would remove the tax entirely for owner-occupied homes…

Two Powerful Marketing Strategies-which one is right for your home?

Off-Market vs. MLS Listings: What’s Better for Bay Area Sellers?

In the competitive Bay Area real estate market, the way you bring your home to market can make all the difference—not just in how quickly it sells, but in how much it sells for. One of the most common questions we hear from sellers is:

“Should I list my home on the MLS or explore an off-market strategy?”

California’s AI Windfall Is Becoming Hard To Live Without—That Could Spell Trouble for the Housing Market

California’s AI windfall is showing up in two very important places for residents: the housing market and the state’s balance sheet.

As AI-fueled gains have kept money flowing through the tech sector, they’ve propped up high-end home demand in tech centers like San Francisco while helping Sacramento plug a nearly $18 billion budget deficit.

That dependence raises a hard question for the Golden State: What happens if the AI boom cools or, as some fear, the bubble pops? With AI gains now supporting so many pillars of the state’s economy, a downturn could rip through the state like a house of cards, given how vulnerable California is.

President Donald Trump has instructed Fannie Mae and Freddie Mac to launch a massive buying spree of mortgage-backed securities to push mortgage rates lower…