Cash Buyers beware—the landscape is changing.

Continue reading1812 El Verano Way, Belmont OPEN SAT & SUN 8/4 & 8/5

1812 El Verano Way, Belmont LISTED FOR $1,598,000

- Remodeled and enhanced with contemporary finishes

- Three generous bedrooms

- Two full taupe-tiled baths

- Rich Oak hardwood flooring

- Owners ensuite with walk-in shower, dual pane windows and recessed lighting

- Freshly updated kitchen with newer sleek modern Samsung® appliances including silent-style dishwasher, five burner gas stove, microwave, stainless basin sink—granite counters

- Large open communal living room with gas insert fireplace, recessed lighting, and new hardwood floors

- New electrical panel

- New front and rear landscaping

- Multiple outdoor dining and entertainment patio areas—grass play area

- Two car attached garage with new modern garage door

- Approximately ~1,220 sq. ft.

- Substantial ~7,102 sq. ft. lot

- Built in 1955– and updated by current owners

- Freshly painted interior with designer colors

- Award winning Belmont schools, near Carlmont High School

- Sought after Central Belmont location, nearby Carlmont Village Shopping Center

- Several blocks from Barrett Park Community Center with its many recreational activities, childcare, dog park and socializing

- Conveniently close to San Francisco International Airport, Half Moon Bay and Coastal towns, major commute arteries, nearby parks and plenty of excellent shopping and dining options

Reports available to qualified parties

1812 El Verano Way, Belmont

HANDSOME REMODELED CALIFORNIA RANCH | COVETED BELMONT HILLS AREA | INCREDIBLE BACKYARD

Designed and constructed by famed engineer and builder, ‘Andy’ Oddstad, this rolling hills location was chosen for its idyllic surroundings and its warmer microclimate—insulated from the cooler western hills exposure–hence the name El Verano, meaning “The Summer”. This post-WWII enclave of modest homes offer spacious lots, wide streets and community friendly sidewalks—rare for Belmont’s rural surroundings.

This single level home resides upon a bluff and enjoys level topography on an oversized lot. The home has undergone extensive enhancements and has been nicely updated with contemporary finishes. New hardwood flooring is throughout the home, along with the generous use of LED recessed lighting.

The nicely updated kitchen features Maple colored soft-close style drawers, granite counters, all new Samsung®stainless appliances including a quiet style dishwasher, five burner gas stove with self-cleaning oven, and French door stainless refrigerator.

Conveniently located in the galley kitchen is a dinette area for casual meals, and the adjacent more formal dining area opens to the spacious living room, augmented by a centerpiece wood burning fireplace, and highlighted by LED recessed lighting. Access to the expansive entertainment patio and newly sodded sunny flat grassy backyard is also available from this room. The amazing rear yard is perfect for evening get-togethers and outdoor enjoyment.

The two-car garage has fresh Shield-Crete epoxy slurry flooring, and new modern roll-up garage door with sidelights and Wi-Fi compatible belt drive Lift Master opener.

It’s coveted location also benefits from its proximity to both downtown areas of Belmont, as well as convenient travel corridors. Located near the Carlmont Village Shopping Center with a variety of retailers, restaurants and popular gathering spots, such as Starbucks, Vivace and Waterdog Tavern with pet friendly outdoor dining. Other businesses include ACE Hardware, and the upscale Lunardi’s Grocery.

For shopping, Hillsdale Mall is a short drive away and is undergoing a complete renovation, with stores such as Nordstrom, Macy’s, Williams-Sonoma, Sephora and Trader Joe’s. Enjoy dining options like Paul Martin’s American Grill, The Cheesecake Factory, California Pizza Kitchen, and The Counter.

Belmont is ideally located on the Peninsula between the Silicon Valley and San Francisco. It’s popular because of its close proximity to major travel arteries—Highways 101, 280, 92. Caltrain and San Francisco International Airport is also conveniently nearby.

Contact us to find out why more people are moving to the Mid-Peninsula. 650-508-1441

Winning the Bid May Actually Be Losing

Are agents terrible at pricing homes for sale, or is there another reason so many homes sell for hundreds of thousands of dollars over the asking price?

When a home is underpriced, or overpriced for that matter, it often has to do with the fact that the listing agent is from out of the area. They miss the mark because in their home turf, homes may be selling for less (or more) than where their listing is located, and when they apply their native pricing strategies to a listing they have out of the area, they can be pretty far off at times.

The same goes for an agent who represents a buyer in an area where they’re not as familiar with the local home values. They may grossly overestimate a home’s worth, based upon their experience in the area where they concentrate, thus recommending an offer price to a buyer that is too high and artificially driving the prices up.

Then there’s the phenomenon known as the “Winner’s Curse”, hence while you may be winning the bid, you’re actually losing. The winner’s curse may occur in any auction where less than complete information is available. The winner’s curse says that in such an auction, the winner will tend to overpay. The winner may overpay or be “cursed” in one of two ways: 1) the winning bid exceeds the intrinsic value of the asset or 2) the value of the asset is less than the bidder anticipated, so the bidder may still have a net gain, but will be worse off than anticipated.

The Winner’s Curse phenomenon also manifests itself in the home buying process in several additional ways, some of which are introduced by the buyers.

When a buyer tries to outbid their competition by purposefully offering more than the home should be worth, just to win the auction, they may win the bid, but by definition, they paid too much, since the average bid typically defines the value, and the winning bid is the outlier.

Since homes are not a commodity, as in oil or gas for example, wherein the value is pretty well understood and, more importantly, oil is oil and it either makes sense to purchased it at “x” price or it doesn’t. Wherein when it comes to homes, at least those located outside of tract areas, are unique unto themselves, and buying a similar home may not be nearly as emotionally appealing. In this way, it’s more like adopting a child, no two are the same.

From a listing agent’s standpoint, pricing a home at the selling price of the home across the street typically backfires. Here’s why. Let’s say that the home across the street was listed at $1,000,000, and sold with ten offers for $1,400,000. The high bidder, who won the bid, and by definition paid too much—because they paid more than any other buyer was willing to bid—is now out of the pool of potential bidders for the next home—the one you just listed across the street. This means out of the nine residual buyers, none were willing to pay $1,400,000 and some may have even already moved on, or are in contract on another home. What did the other nine buyers bid? Only that listing agent will ever know, but the next highest bidder is the one you need to attract and who knows how much they offered. And this of course assumes that the homes are identical—which they never are. The second highest bidder might not even like your listing, might be out of town the week you go on the market, which means now you are relegated to the third, fourth, or fifth bidders in order of their declining tolerance for bidding or ability to pay.

This is one reason agents will intentionally list a home at what seems to be irresponsible—far below what it might eventually sell for, based upon the recent comparable sales in the area. And while this practice might be viewed by some as false advertising, which is illegal, as the home might well be priced lower than recent sales, it might actually be priced appropriately for its intrinsic value.

In residential real estate valuation, there are several ways to ascertain the intrinsic value of a home. The three accepted practices in real estate are known as the Comparative Market Approach, also known as the sales comparison approach, the Principle of Substitution, (what else could I buy), and the Cost Approach, (how much would it cost to build a similar home from scratch).

Agents and buyers alike tend to rely heavily on the sales comparison approach, as it makes sense to compare the home they are buying to those which have recently sold, but if the buyers are bidding too much on homes, than the comparable sales are less trustworthy, and looking at the Cost Approach, or what it would cost to build a new home might be more effective, if nothing more as a check and balance against the price one might offer.

___________________

______________________________________________________

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 25 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and the top 3 in Northern California. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomes and on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario

What a Mortgage Deduction Reduction Could Do to Home Values

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomesand on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario.

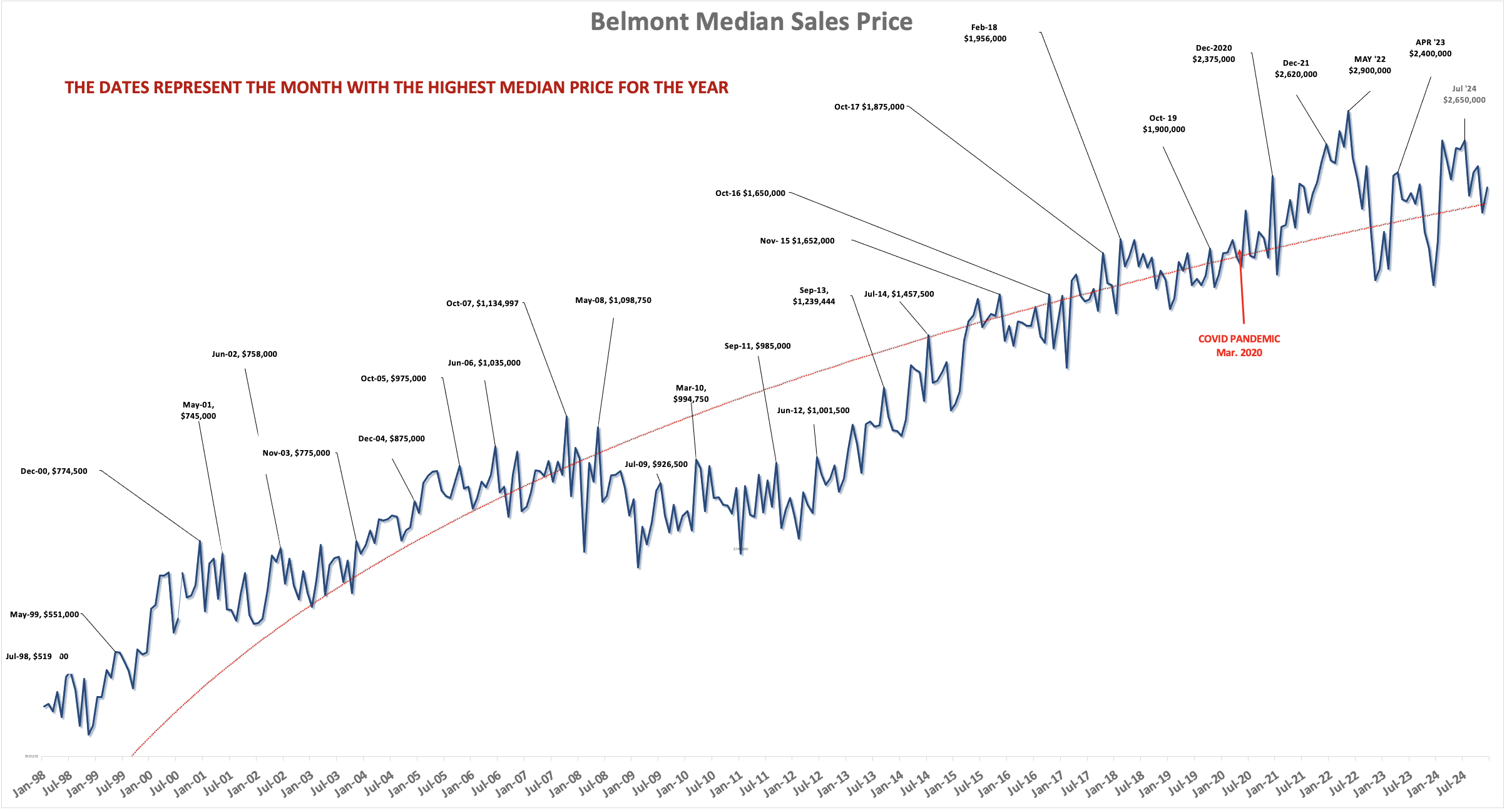

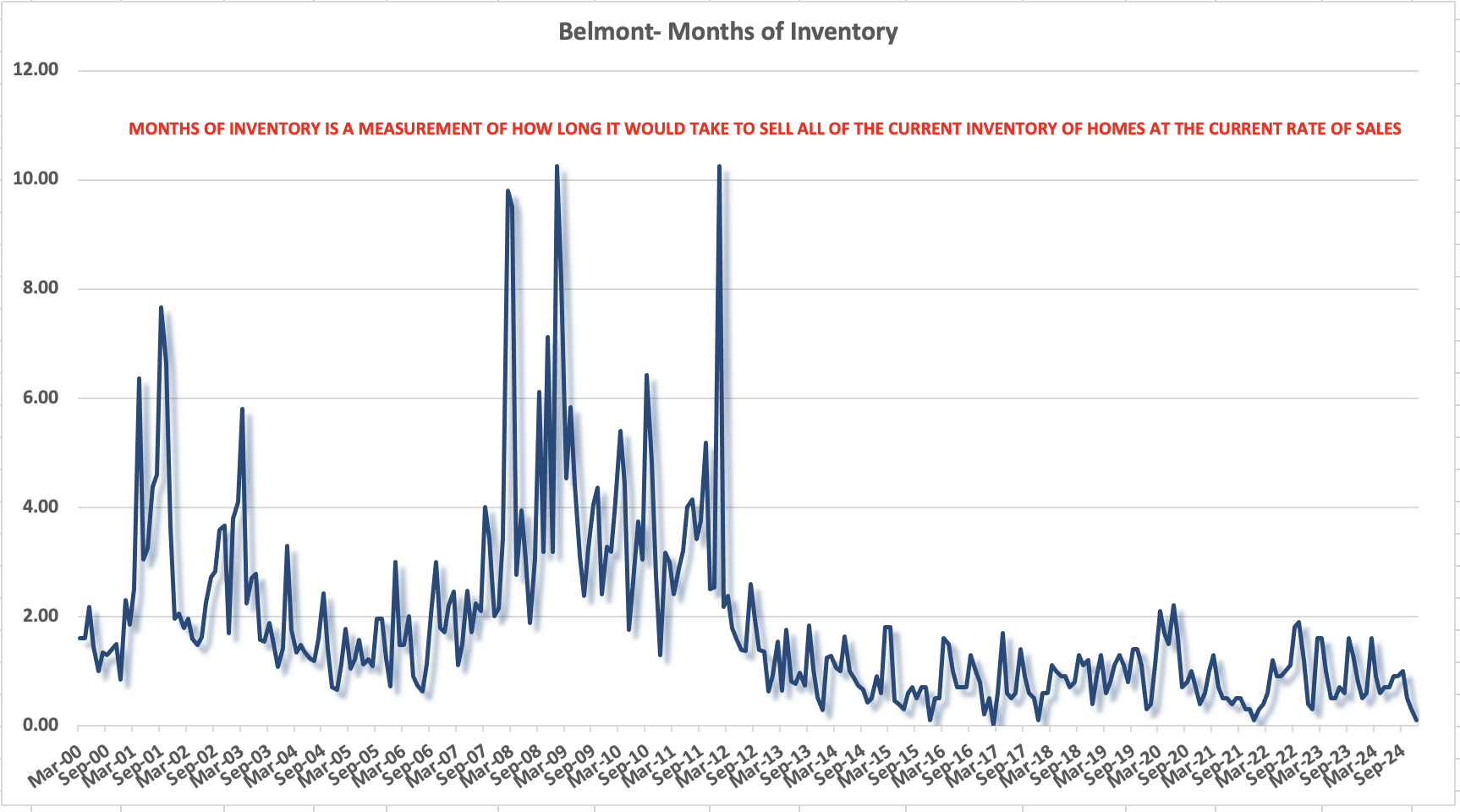

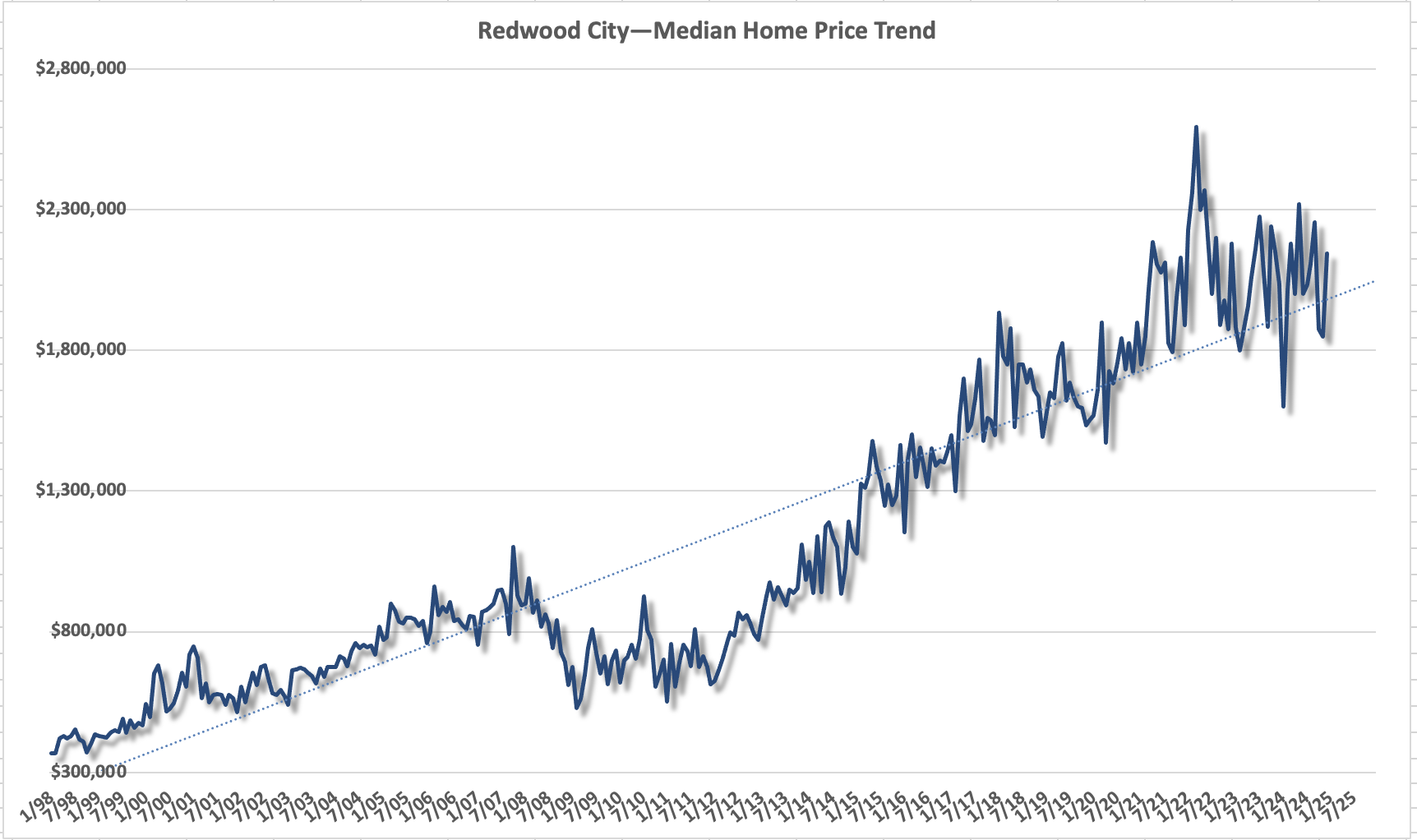

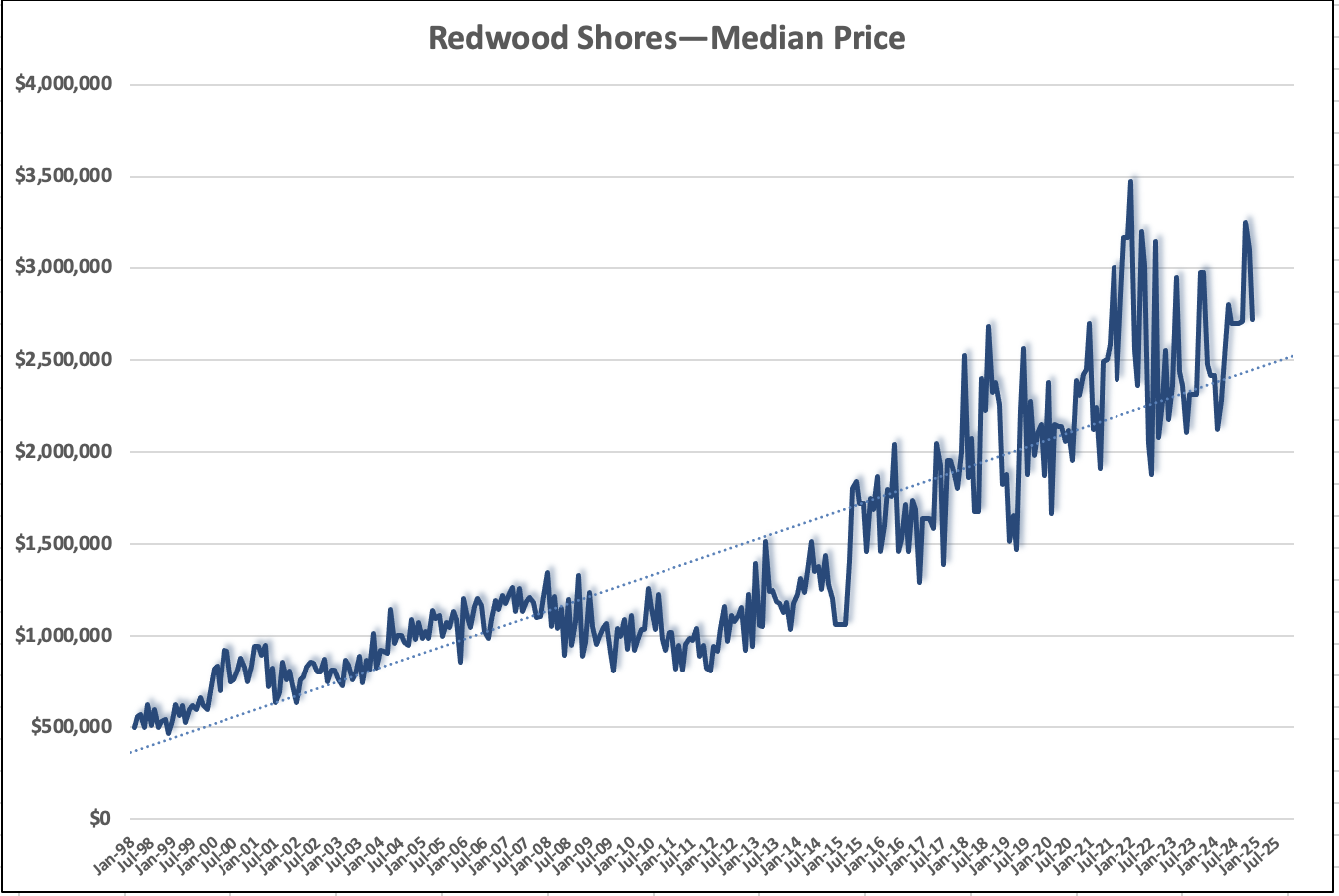

Belmont Home Value’s Increase—Is There No End in Sight?

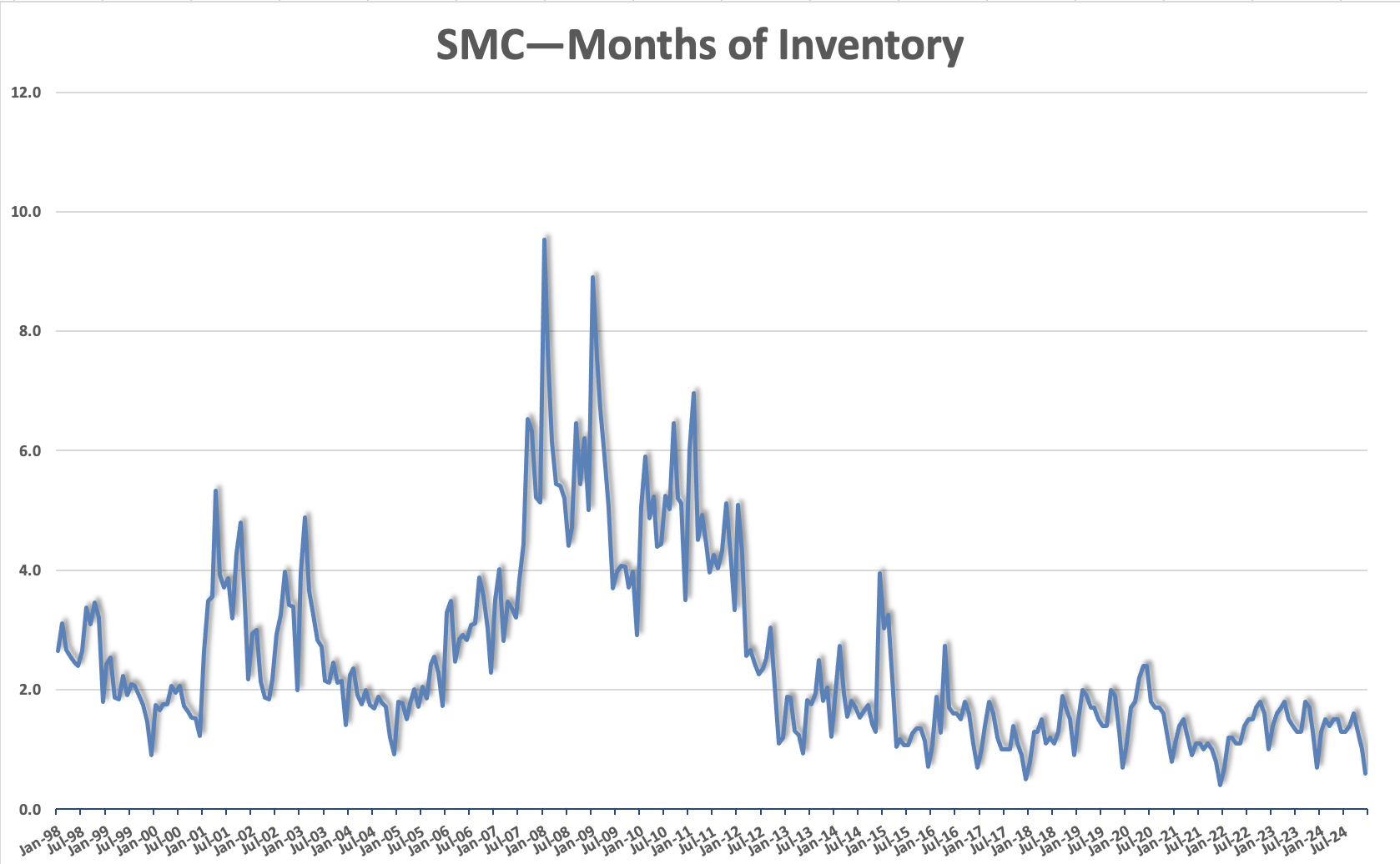

Before we head into the winter slow season for home sales, we’ll take a quick look back at Q3 home sales for Belmont, and the larger San Mateo County.

BELMONT & SAN MATEO COUNTY

HOME SALES—

Belmont had 78 new listings in Q3 as compared to 64 last year during the same period, and increase of 18%.

San Mateo County’s inventory of new listings dropped 6% YOY

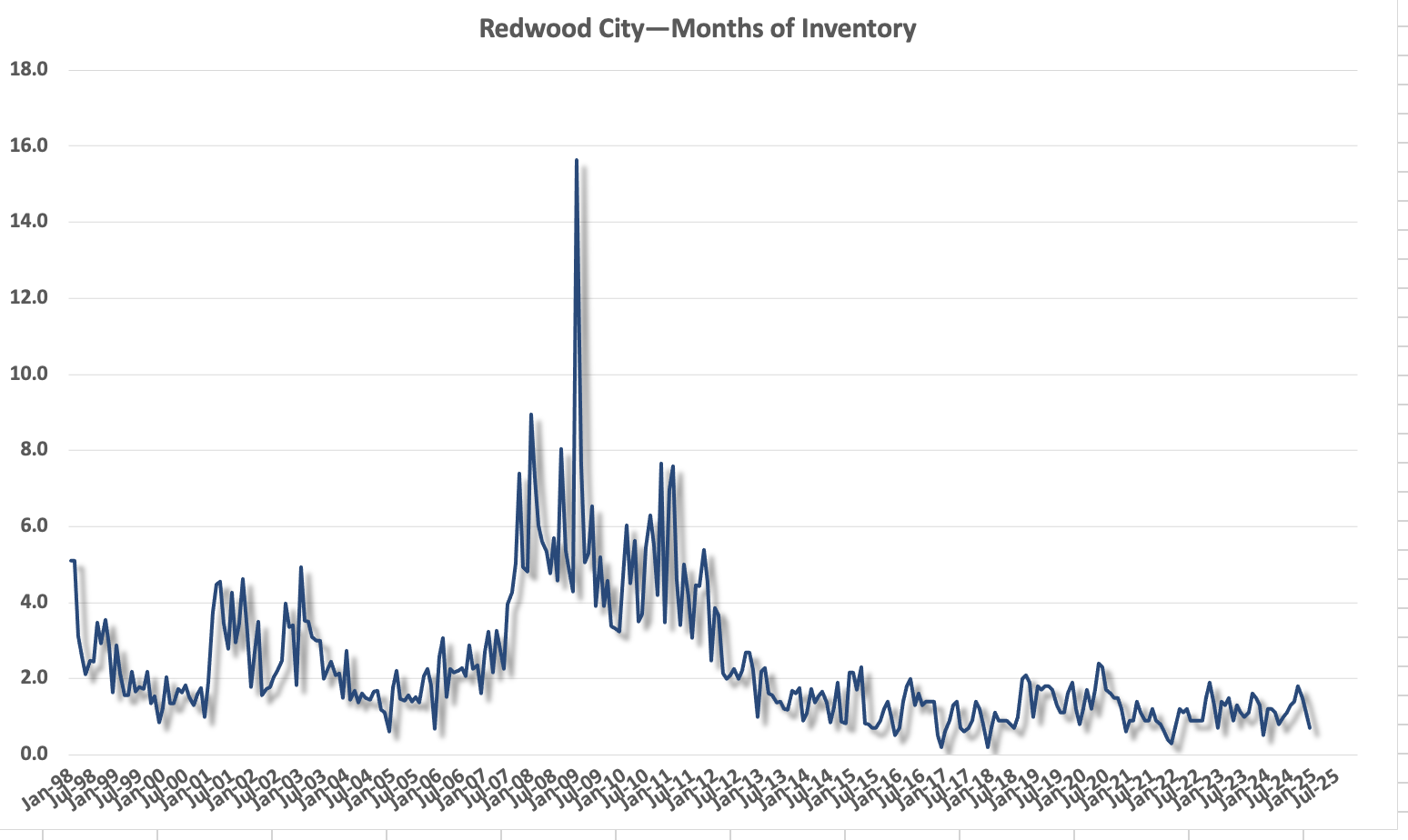

INVENTORY/SALES—

Ironically, even with more new listings the inventory dropped 21% YOY. Why? Because sales increased 17% eliminating housing inventory.

SMC’S overall inventory also dropped—31% YOY, and sales dropped by 3.4%

DAYS ON MARKET (DOM) —

The time it took to sell a home in Belmont, on average, dropped from 16 days to 14

SMC Days on market dropped from 27 to 23

MEDIAN HOME PRICE

The median home price increased 12.7% YOY for Q3 for closed homes. When we compared the size of the homes selling in the two periods, there was statistically no difference, at 1784 ft² in 2016 and 1,748 ft² in 2017—so we made no adjustment for square footage interfering with the median home price swing. Note that Belmont it an all-time median home price point this October 2017.

San Mateo COUNTY’S MEDIAN HOME PRICE ROSE 9.5% YOY IN Q3

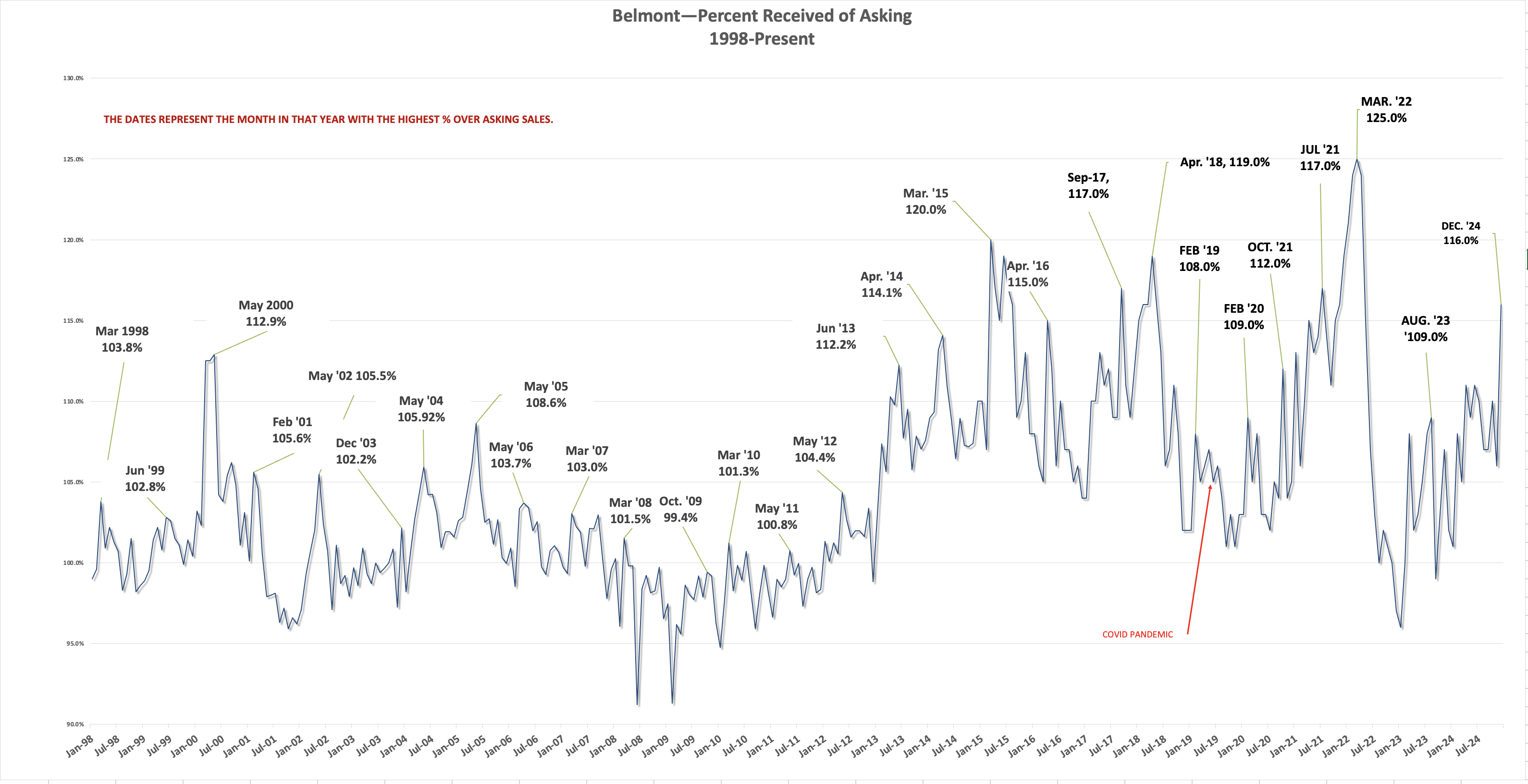

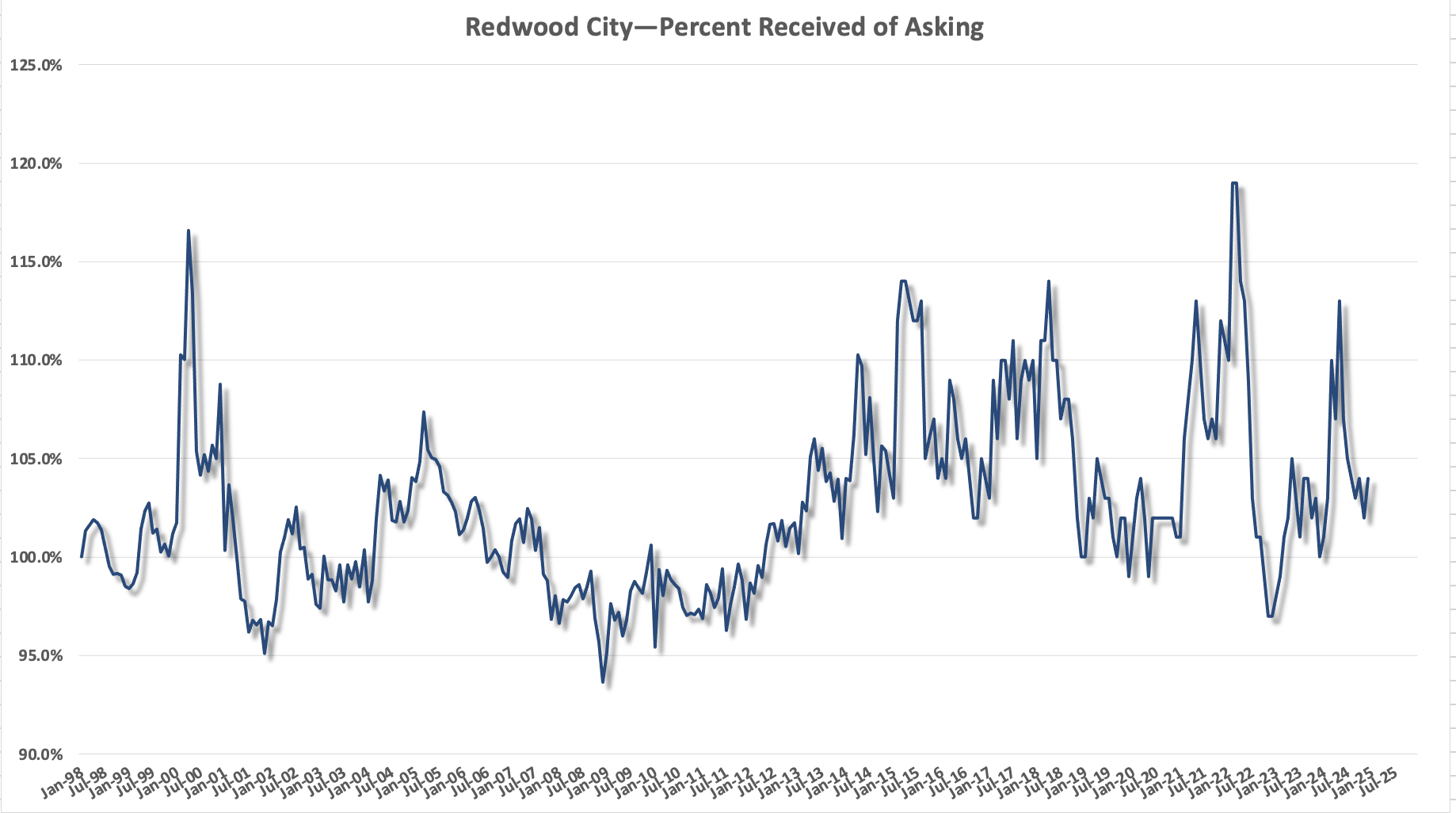

PERCENT RECEIVED

Belmont home seller’s eked out 4.4% more for their homes over their list price than last year during the same period.

In San Mateo County that number went up to 3.7% of asking

WRAP-UP

In every category in regards to home sale activity, Belmont outperformed and outpaced San Mateo County leading speculation that the peak for Belmont home values have not yet been reached.

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and the top 3 in Northern California. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomes and on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario

Waterdog Tavern in Belmont-What’s in a Name?

Waterdog Tavern

We were delighted as were many Belmont residents with the opening of a new restaurant, Waterdog Tavern in the Carlmont Village Shopping Centre last year. This past Spring, they opened the spacious outdoor area for sociable dining in a “dog friendly” environment, and we now visit frequently with our dog, Wyatt.

We were delighted as were many Belmont residents with the opening of a new restaurant, Waterdog Tavern in the Carlmont Village Shopping Centre last year. This past Spring, they opened the spacious outdoor area for sociable dining in a “dog friendly” environment, and we now visit frequently with our dog, Wyatt.

If you see us outside with this friendly little guy, stop by to say hello!

One of the questions we often hear: Where did they get the name Waterdog Tavern?

One of the questions we often hear: Where did they get the name Waterdog Tavern?

Since Belmont is our home, and we’re quite familiar about our local history, we knew at once where they got the clever name. We asked the owners, Toby and Anne, who often get asked the same question, to weigh in for our readers about the backstory of why they picked the name they did. Enjoy!

Toby McMillan (Owner):

Our family moved to Belmont from Sacramento in 2006. Not long afterwards Anne & I were strolling through Carlmont Village for the first time, when we came upon the outdoor area where the old Carlmont Nursery used to display their huge selection of Japanese Maples. We both remarked how beautiful the space was, and hoped that someday the adjacent restaurant (Hola!) might make arrangements to serve food & beer in the outdoor space – a few picnic tables would be great. I remarked, not very seriously at the time, that if it were ever possible to get both of those spaces, we should jump on the chance.

Fast forward to the Fall of 2015. After seriously searching for a couple of years for the right space to open a new restaurant that had outdoor seating and great parking, Carlmont Nursery and Hola! decided to close their doors within a month of each other. We pinched ourselves that two spaces had become available simultaneously and set out to create a casual, comfortable, warm, inviting restaurant, where the community and those traveling by The Village could gather to enjoy great food & drinks – The Tavern concept was born. Now…what to name it?

We had come up with different names for other concepts, but they were all location specific and would not work with what we had planned for this restaurant. As Belmont residents, we wanted the name to reflect the surroundings and the casualness of the concept. One day I was talking to a friend, and they mentioned they had taken their dog for a walk at  Waterdog Lake, and a light bulb went on: Waterdog Tavern! Waterdog Lake is not only a long time Belmont landmark, but is known by folks up & down the Peninsula. To add to that, we had already begun tossing around the idea of making the Beer Garden dog friendly, and with so many local residents walking their dogs at Waterdog Lake on a regular basis it seemed a perfect fit.

Waterdog Lake, and a light bulb went on: Waterdog Tavern! Waterdog Lake is not only a long time Belmont landmark, but is known by folks up & down the Peninsula. To add to that, we had already begun tossing around the idea of making the Beer Garden dog friendly, and with so many local residents walking their dogs at Waterdog Lake on a regular basis it seemed a perfect fit.

Now with that being said, we are aware that the name of Waterdog Lake has nothing to do with dogs, but was coined because the lake (officially named Notre Dame Lake) used to teem with salamanders, and ‘waterdog’ is a salamander nickname. Anne has fond childhood memories of spotting waterdogs in her Grandma’s fountain in Belmont. Having made the decision to make the Beer Garden dog-friendly, we came up with our ‘Shaking Dog’ logo as a bit of a play on words. A recognition of all of the waterdogs that we all know and love, including our Australian Shepard, Buddy… We mean no disrespect to salamanders and have enjoyed sharing our story with guests!

Belmont Home Price Increases Slow to a Crawl

In each of our Newsletters we bring you the recent Belmont home sales for the previous month. This time we thought we’d stack up the months of August to the same time last year, so the variance from the previous year is obvious.

The first thing that jumps out at us is that there were 33% fewer sales overall. If we take out the one off-market sale in 2016, the time it took for the homes to sell really didn’t change. Homes are still selling briskly at about 10-14 days on the market—which really is more dependent upon which day the seller elects to hear offers.

There were two homes which underwent a price reduction before selling, and one home that sold for under the seller’s asking price in 2017, and none in 2016. Still, the amount the seller’s received stayed at around 108% of the seller’s asking price.

Since the size of homes which sold in both years was statistically unchanged, the median price difference YOY is very reliable. It shows that homes in Belmont rose on average almost 10% YOY with the median home price rising a modest 5.13 %. Are we near the top of the market? These almost nominal increases would suggest so, though to a buyer, in real dollars, the medium price home in Belmont just went up $75,000.

[CLICK ON THE IMAGE FOR A FULL SIZE RENDERING]

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and the top 3 in Northern California. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomes and on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario.

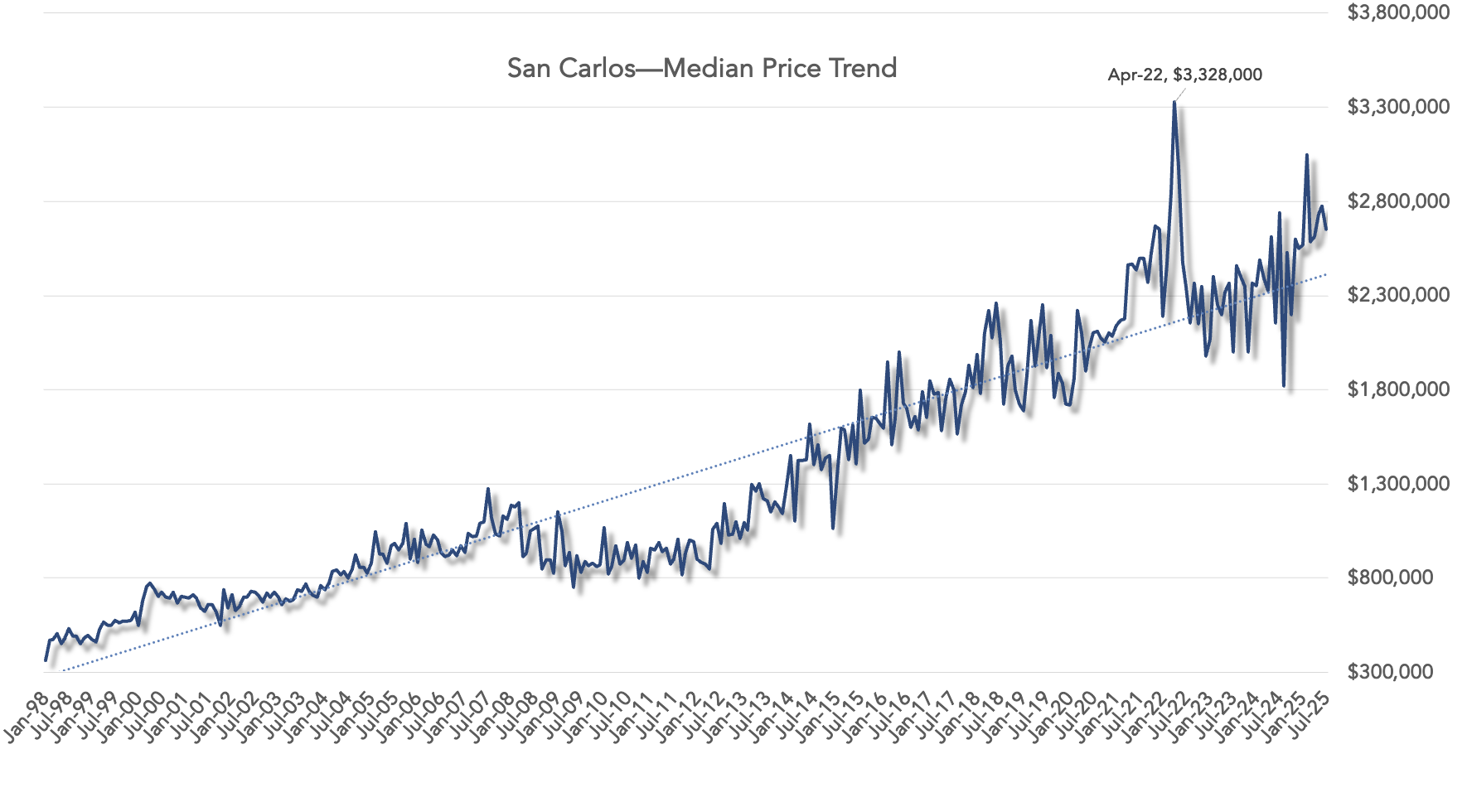

Bay Area Home Values Eclipse Historical Records

Case Shiller Report for June 2017

The Case-Shiller Report was released June 27th, the last Tuesday of the month, which tracks home sales in 20 metropolitan cities around the country, called MSA’s, of Metropolitan Statistical Areas.

Our MSA (Metropolitan Statistical Area) in the Bay Area consist of five counties—Marin, San Francisco, San Mateo, Alameda and Contra Costsa. It’s important to note that while home values might be headed upward at a dramatic pace in the counties of San Francisco and San Mateo, they might be lagging in Alameda and Contra Costa, thus diluting the upward trend in one county vs. the whole MSA. This has been the case in our area since the housing recovery began in earnest in 2012.

The same goes for the 20 city composite index, which takes 20 metropolitan cities in the country and tracks them as an average trend.

While the 10 and 20 city composite indices shows that the housing market has not yet eclipsed the all-time high recorded around March of 2006, in the Bay Area, we have.

This graph which we built utilized the data from Case-Shiller for our SFMSA and illustrates that we have reached a new all-time high for home values. However, it’s important to note that the delta between the trend line and the peak where we are today, illustrating where the straight-line home values should be, is far less than in the peak of 2006, where we see a much great deviance off the trend line values. In fact, the peak of 2006 was 58% higher above the trend line than it is today.

One might infer from this that we are not as overvalued as it might appear at first glance.

This give some credence to the synopsis for the Standard and Poor’s Case-Schiller analysis and discussion.

Case-Shiller Analysis by Standard & Poor’s— ANALYSIS

“As home prices continue rising faster than inflation, two questions are being asked: why? And, could this be a bubble?” says David M. Blitzer Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Since demand is exceeding supply and financing is available, there is nothing right now to keep prices from going up. The increase in real, or inflation-adjusted, home prices in the last three years shows that demand is rising. At the same time, the supply of homes for sale has barely kept pace with demand and the inventory of new or existing homes for sale shrunk down to only a four- month supply. Adding to price pressures, mortgage rates remain close to 4% and affordability is not a significant issue.

“The question is not if home prices can climb without any limit; they can’t. Rather, will home price gains gently slow or will they crash and take the economy down with them? For the moment, conditions appear favorable for avoiding a crash. Housing starts are trending higher and rising prices may encourage some homeowners to sell. Moreover, mortgage default rates are low and household debt levels are manageable. Total mortgage debt outstanding is $14.4 trillion, about $400 billion below the record set in 2008. Any increase in mortgage interest rates would dampen demand. Household finances should be able to weather a fairly large price drop.”

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and the top 3 in Northern California. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomes and on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario

How Much Should I Bid to Win the Home?

How Much Should I Bid to Win the Home? You’ve found the ideal home, and now it’s time to make that offer. The offer to beat the other five offers you hear the sellers may be receiving.

When trying to determine an offer price, where do you start, or stop? Of course, your agent should be armed with the recent sales in the area to help you understand at what price the home you’re interested in could sell for.

Remember that in most cases, the buyer that was willing to pay more for the home than any other buyer is the one that typically wins the bid. So, you can forget about saying you don’t want to overpay in this market. By definition, if you won the home in a multiple bidding situation, you probably overpaid. But relax, now your home will be the sales comparable for the next buyers, that likely will now have to pay more than you did. Think of it to some degree like musical chairs, get your home before the music stops. The sooner you get into an appreciating market, the sooner you get to begin enjoying the appreciation, instead of bidding against it.

Remember that in most cases, the buyer that was willing to pay more for the home than any other buyer is the one that typically wins the bid. So, you can forget about saying you don’t want to overpay in this market. By definition, if you won the home in a multiple bidding situation, you probably overpaid. But relax, now your home will be the sales comparable for the next buyers, that likely will now have to pay more than you did. Think of it to some degree like musical chairs, get your home before the music stops. The sooner you get into an appreciating market, the sooner you get to begin enjoying the appreciation, instead of bidding against it.

How to Set a Fair Price

Deciding what to offer can be a nail biting experience. You don’t want to lose the home, but you also don’t want to be blindly bidding against yourself. How much is too much? When you can’t afford anymore is one good threshold. But assuming you’ve looked at what the market bears for like properties, it’s likely that you’ll already know where you think the home should sell. So, pick a price and stick to it. Ask yourself, at what price am I willing to let go of this home? That way, if you win the bid, you’ll be happy and if you lose, you’ll at least know that going any higher just didn’t make sense. Remember, you have to sleep at night so you’ll have to live with whatever decision you make—choose wisely, and remember, sometimes you just have to let a home go if you are up against an overzealous buyer.

How Much Does the Home Need to Appraise For?

Lenders typically want you to put down 20% to have some skin in the game so to speak. Though as lending trends are beginning to loosen, some 10% loans are available.

Let’s say the offer you are going to make on the home you like is for $1,000,000. If you were putting down 20% that would be a $200,000 down payment and the lender would put up the remaining $800,000. Now the home must appraise for full value-—$1,000,000, as the lender will only lend 80% of wherever the home appraises. And that’s what makes sellers nervous—especially if your offer price is a new high water mark for the neighborhood. But if you could put down 25%, the home would only need to appraise for $937,500, giving both you and the seller some breathing room and peace of mind.

Here’s how the calculation works:

“X” = ((Offer price – Down Payment) ÷ .8) or (80%)

Where “X” is what the home must appraise for given the Down Payment.

So in our above example,

$1,000,000 — $250,000 = (25%)= ($750,000 ÷ 80% ) = $937,500.

We also wrote an article about Contingencies, which explains what happens when a home doesn’t appraise

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and the top 3 in Northern California They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomesand on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario

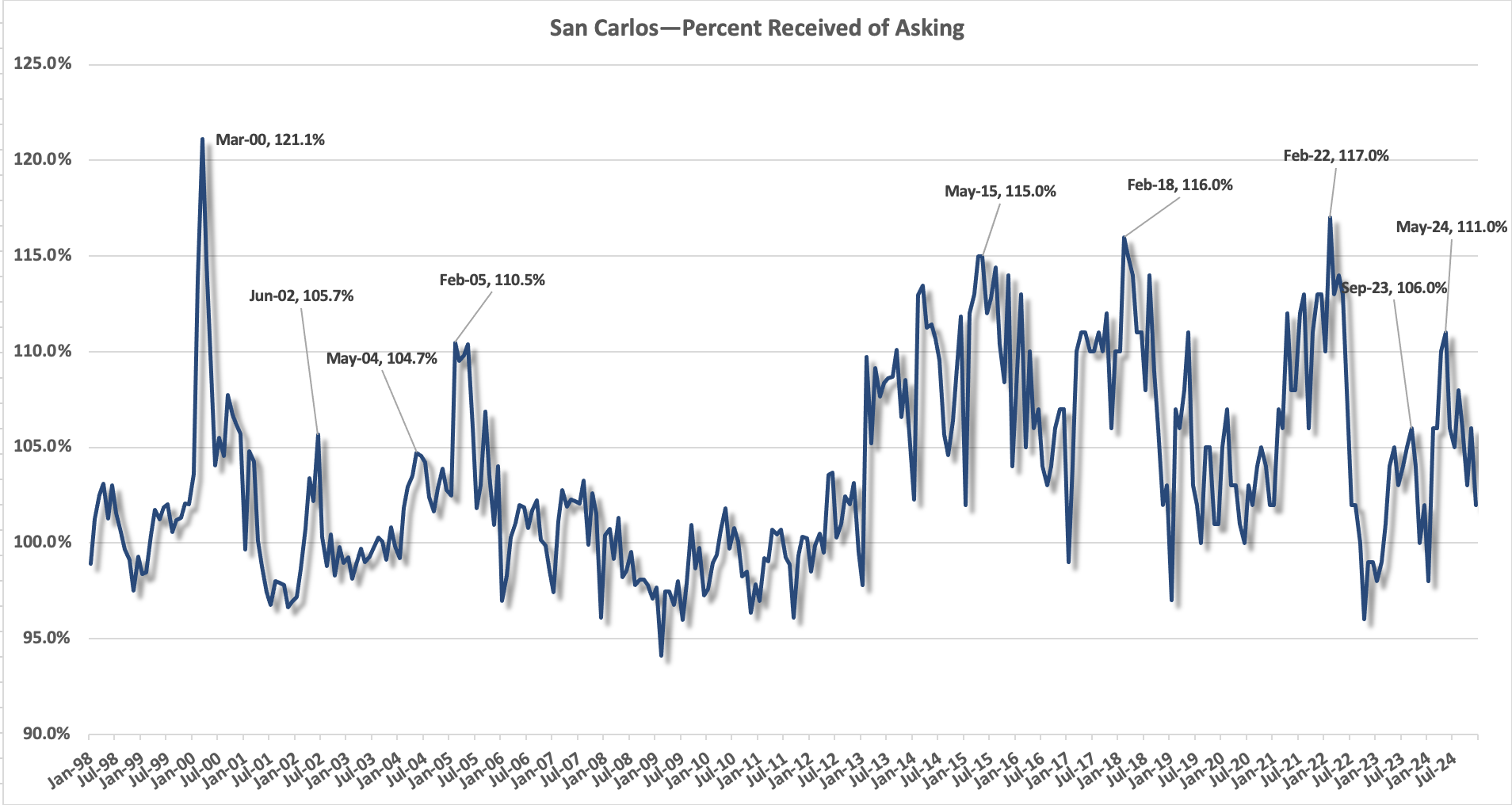

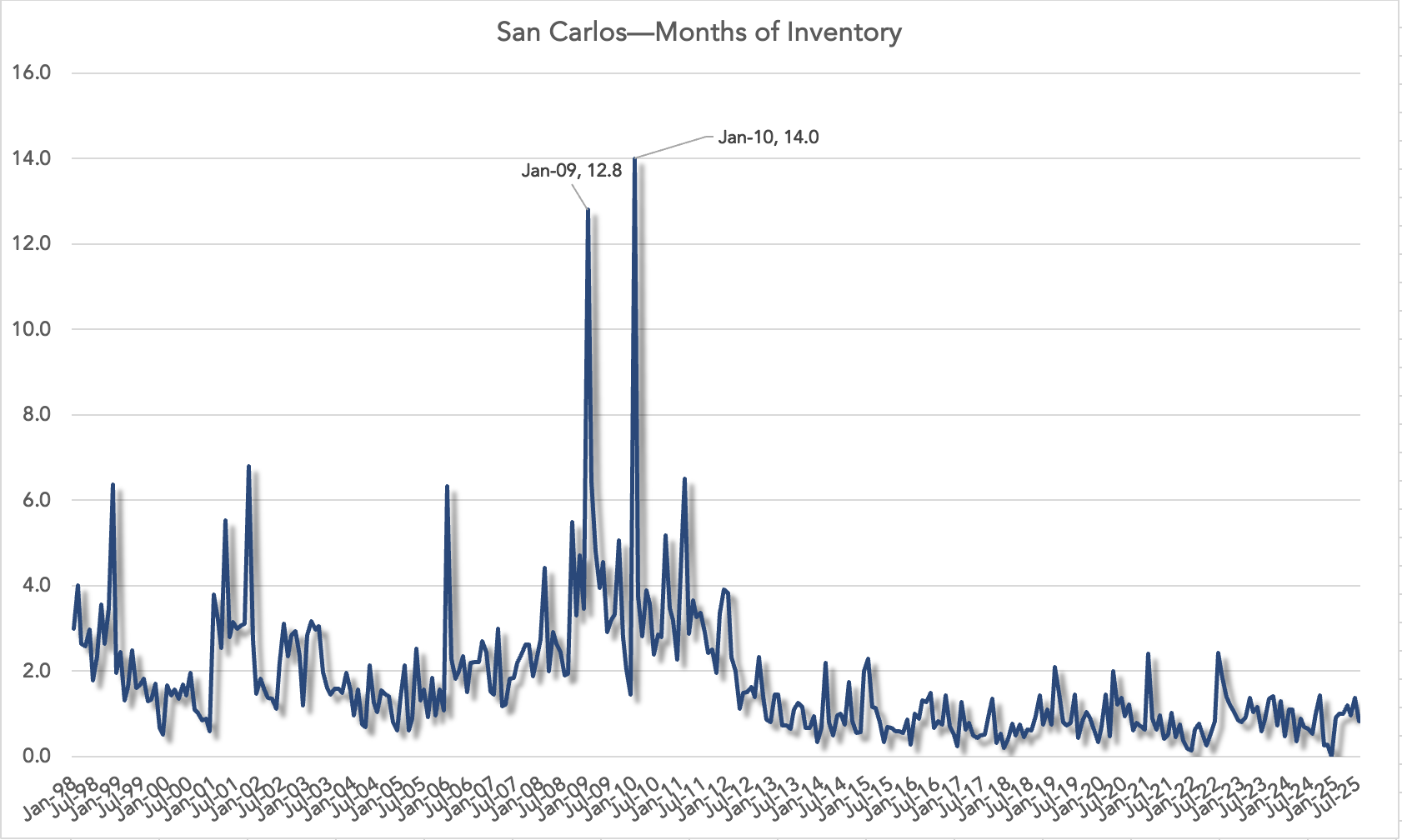

Will There Be an End to Home Bidding Wars?

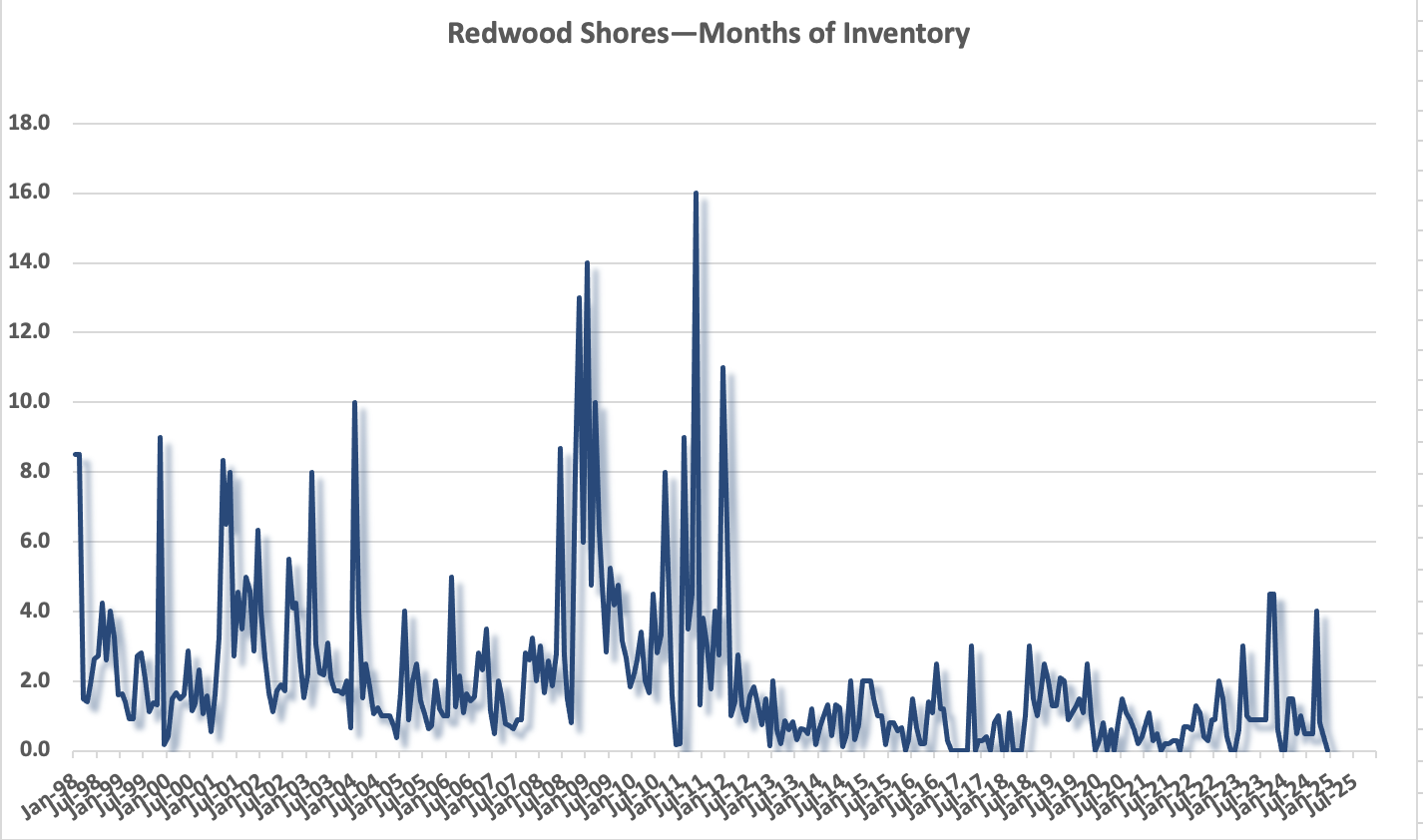

With unusually low home inventory levels, many buyers are feeling frustrated and overwhelmed at the prospect of ever getting their ideal home, or have first-hand experience at losing the home of their dreams in a bidding frenzy.

Yet not all homes sell for over their asking price. In fact many sell below. Granted, they may seem far and few between, but they are out there. In fact, so far in 2017, 25% of San Mateo County home sales sold for less than what the sellers were asking. Many wouldn’t think that’s true, and we’d be willing to bet that if asked, many would say that it’s a lot less, like 1%, but they’d be wrong. Perception is not always reality. The media’s constant coverage of how “crazy” the housing market is, has been drummed into the minds of buyers—and sellers. And the homes that people see closing well above the asking price, only serve to validate the overall impression that the market is overzealous. And that emboldens people’s impressions, but it’s more of an emotional response, than one of accuracy. It is however, what people talk about and what they remember.

We sold a home just last month at 534 Wellington Avenue to a buyer of ours. The sellers expected six offers and received none. We stepped in and delivered a full price offer and it was accepted. It’s the second lowest 3 bedroom sale in San Carlos on the west side this year.

One way to get a good deal is to focus on homes which have been initially overpriced. Any home which is still on the market after 14 days is probably one that will need a price reduction, or may be willing to take a lower offer. These are opportunities that buyers may want to focus on if the multiple bids are giving rise to second thoughts about buying a home.

As for timing the market, there are times of the year that homes get more attention and more multiple offers. We just went through that period—February, March, April and now May. A lot of “why” homes sell with more offers and at a higher percentage of the sellers asking price has to do with several factors.

[Click on the graph below for a larger image]

As the new year begins, buyers and sellers are slow to come out of their market hibernation, but buyers seem to thaw out first. Many buyers have just received their end-of-year bonus, which they had been waiting for to jump into the housing market.

Some buyers with children are desperately trying to get a home in order to get their kids registered into a new school before the vacancies fill up—most first enrollment periods end within the first month or two of the start of the school year.

Another influence is that buyers who had lost out on homes in the prior year now focus more than ever on not losing out again, and they bid more aggressively than other buyers who may be just dipping their toes into the waters. And by June, these more aggressive buyers have all won—they have their home and the buyers that are left are the less aggressive buyers and overbids begin to wane. This typically happens around June, as this graph above of San Mateo County home sales since the turnaround in 2012 illustrates. It’s important to note however, that while the percentage a seller receives, and the number of overbids may be fewer, that doesn’t mean that prices decline. A high home price bar has already been established in the spring and it typically carries through until the end of the year. [Note: These statistics typically lag the market by a month—the typical escrow period. So a high sale percentage in May, was likely consummated in April].

Then of course there’s the competitive spirit. Buyers want what other buyers want and often a bidding frenzy ensues, pushing prices perhaps higher than they otherwise would be. It’s important to note that the aggressive buyer gets the home—the buyer that was willing to pay more than any other buyer at that moment in time. Did they overpay? Perhaps. But now they are a comparable sale for the next home, which invariably will sell for more, and so on and so forth until at the end of the year we have “appreciation”.

Drew & Christine Morgan are REALTORS/NOTARY PUBLIC in Belmont, CA. with more than 20 years of experience in helping sellers and buyers in their community. As Diamond recipients, Drew and Christine are ranked in the top 50 RE/MAX agents nationwide and 3rd in Northern California. They may be reached at (650) 508.1441 or emailed at info@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook at https://www.facebook.com/Morganhomesand on Twitter @ https://twitter.com/morganhomes

The information contained in this article is educational and intended for informational purposes only. It does not constitute real estate, tax or legal advice, nor does it substitute for advice specific to your situation. Always consult an appropriate professional familiar with your scenario.