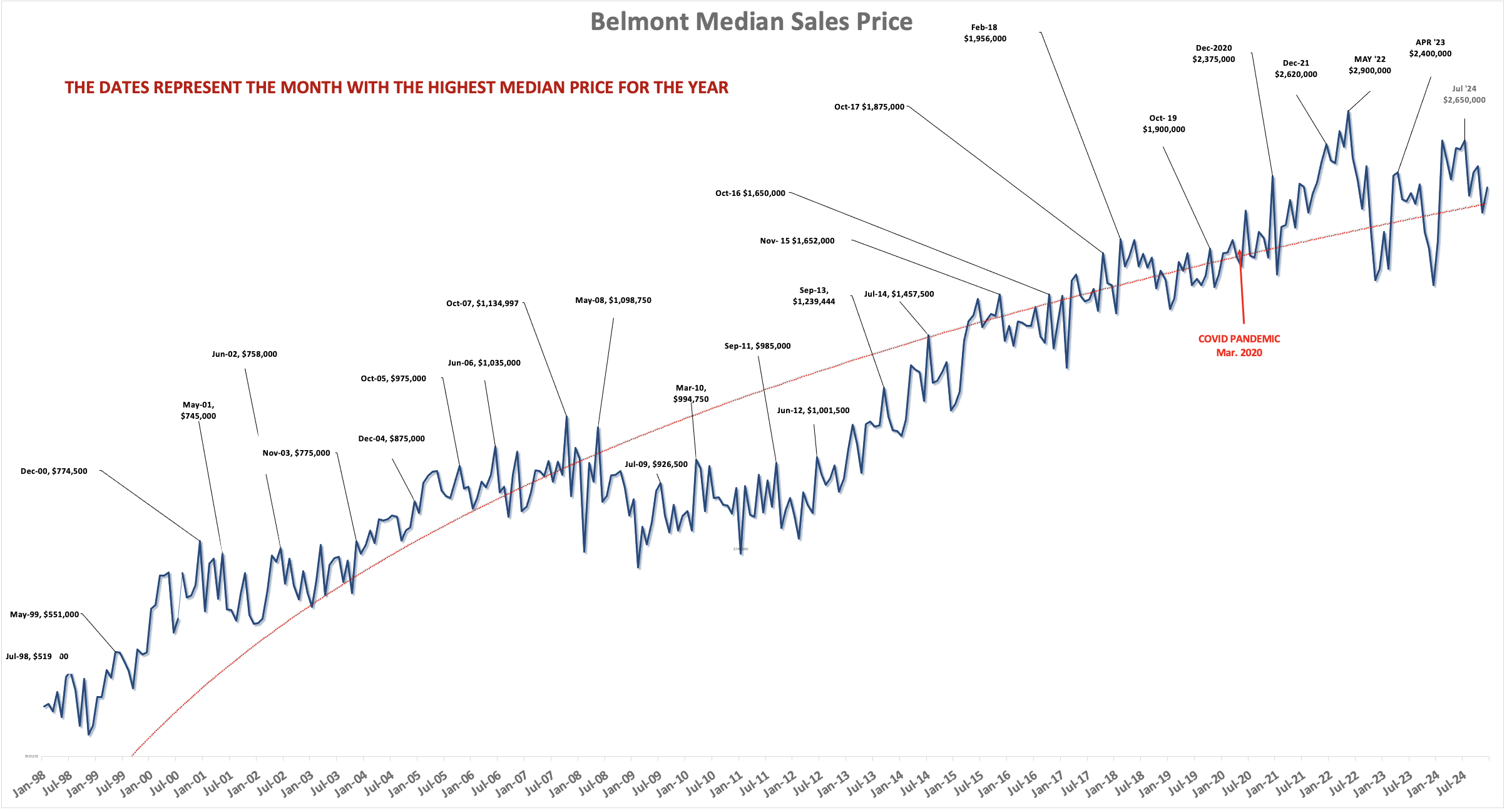

We’re busy compiling the numbers from 2007 to see where the housing market ended compared to 2006. Of course the peninsula market fared relatively well compared to many California cities and that of other states.

Why did certain areas do better? We look at understanding the issues which caused the current market conditions to predict which areas will be impacted more than others.

The jolt that knocked over the housing house of cards was interest rates and adjustable teaser rates indexing to higher levels. In the past five years many investment properties were purchased with adjustable loans. This enabled an investor to break-even on their mortgage payment vs. the rent they could charge. With properties appreciating at levels from 20-50% per year, it’s easy to see why so many investors jumped at the chance to buy in a new development. A new home often means great financing (available through the developer); purchase incentives, literally no maintenance issues; in fact many speculators purchased unfinished homes and re-sold them six months later at completion for a tidy profit.

The first shoe to drop:

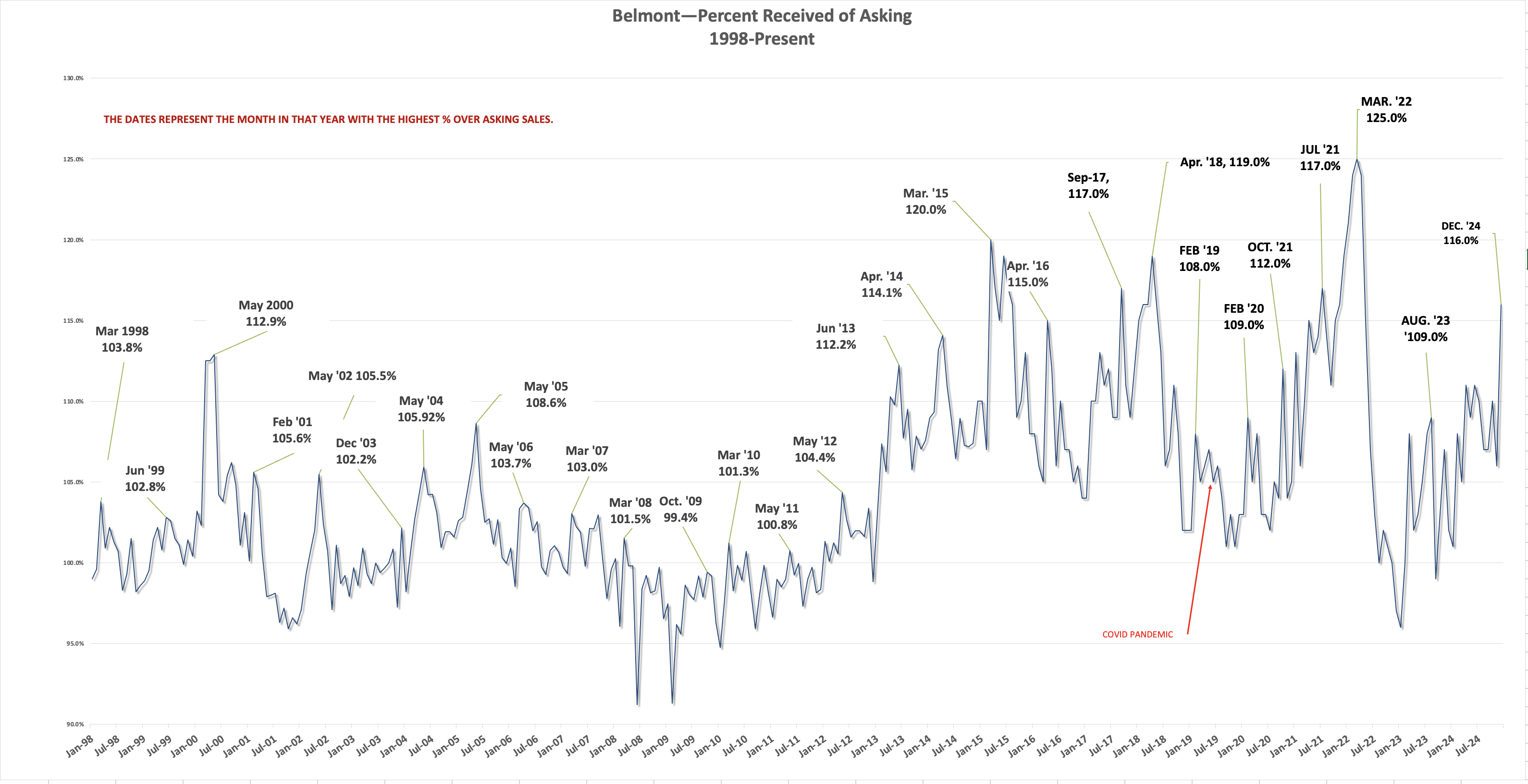

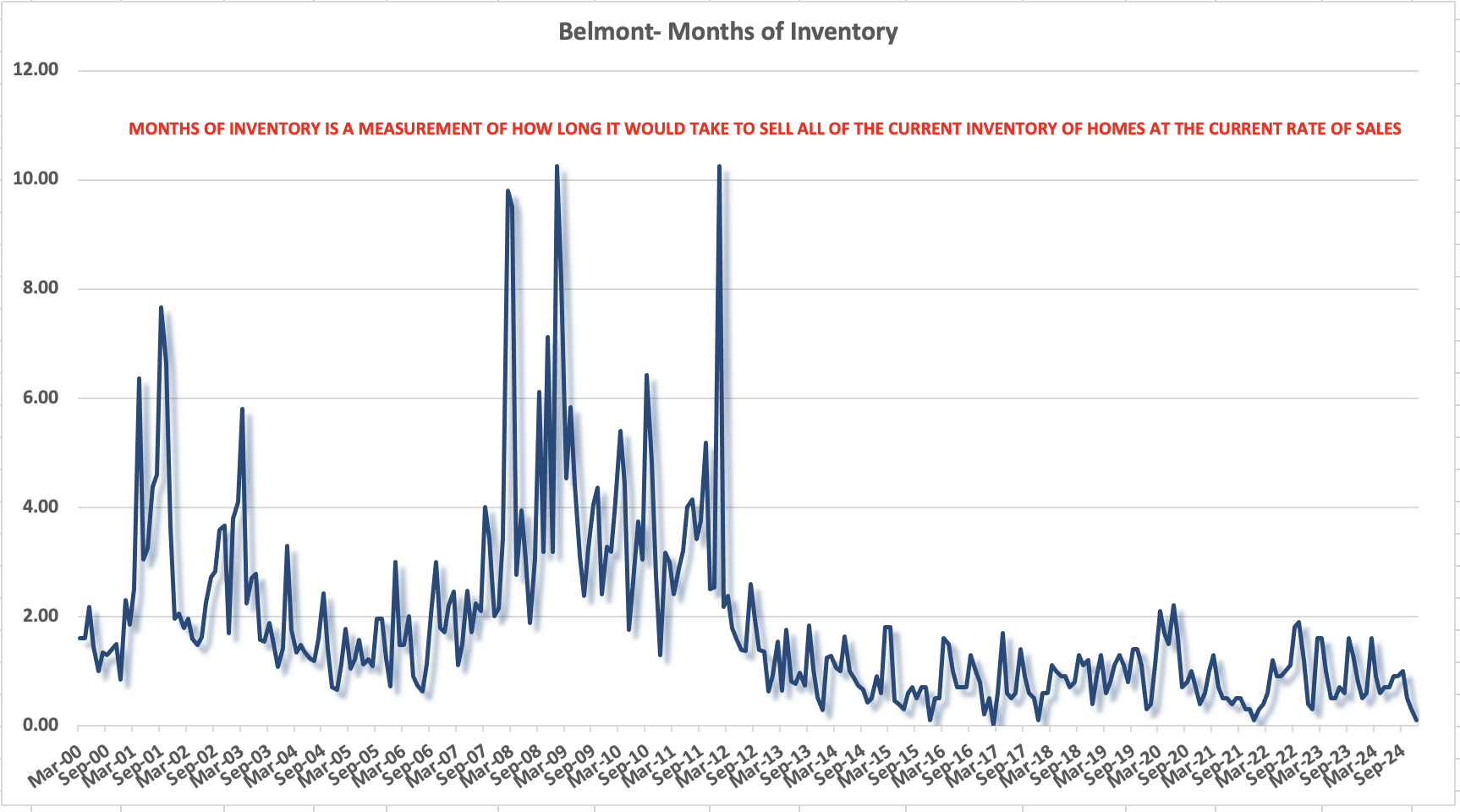

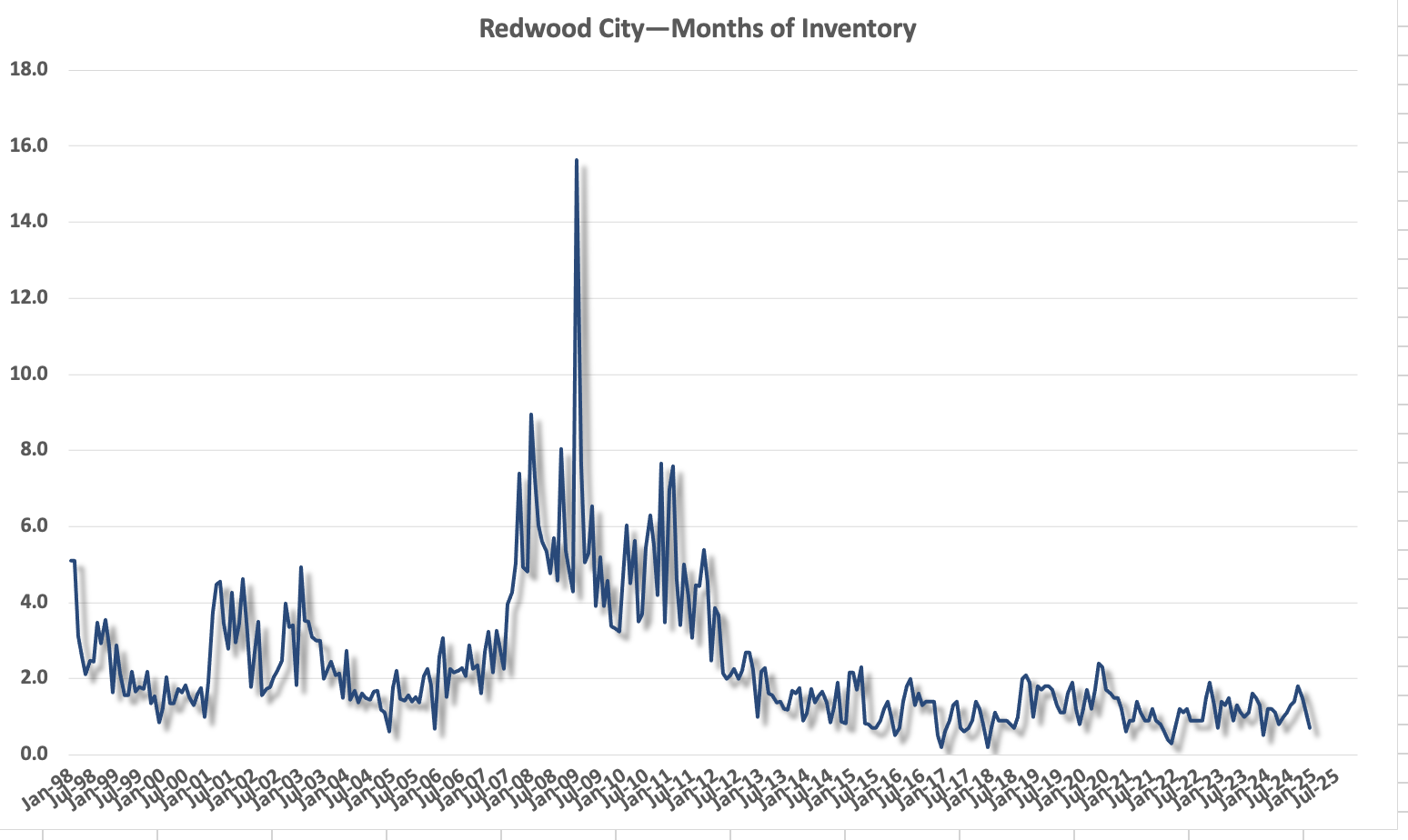

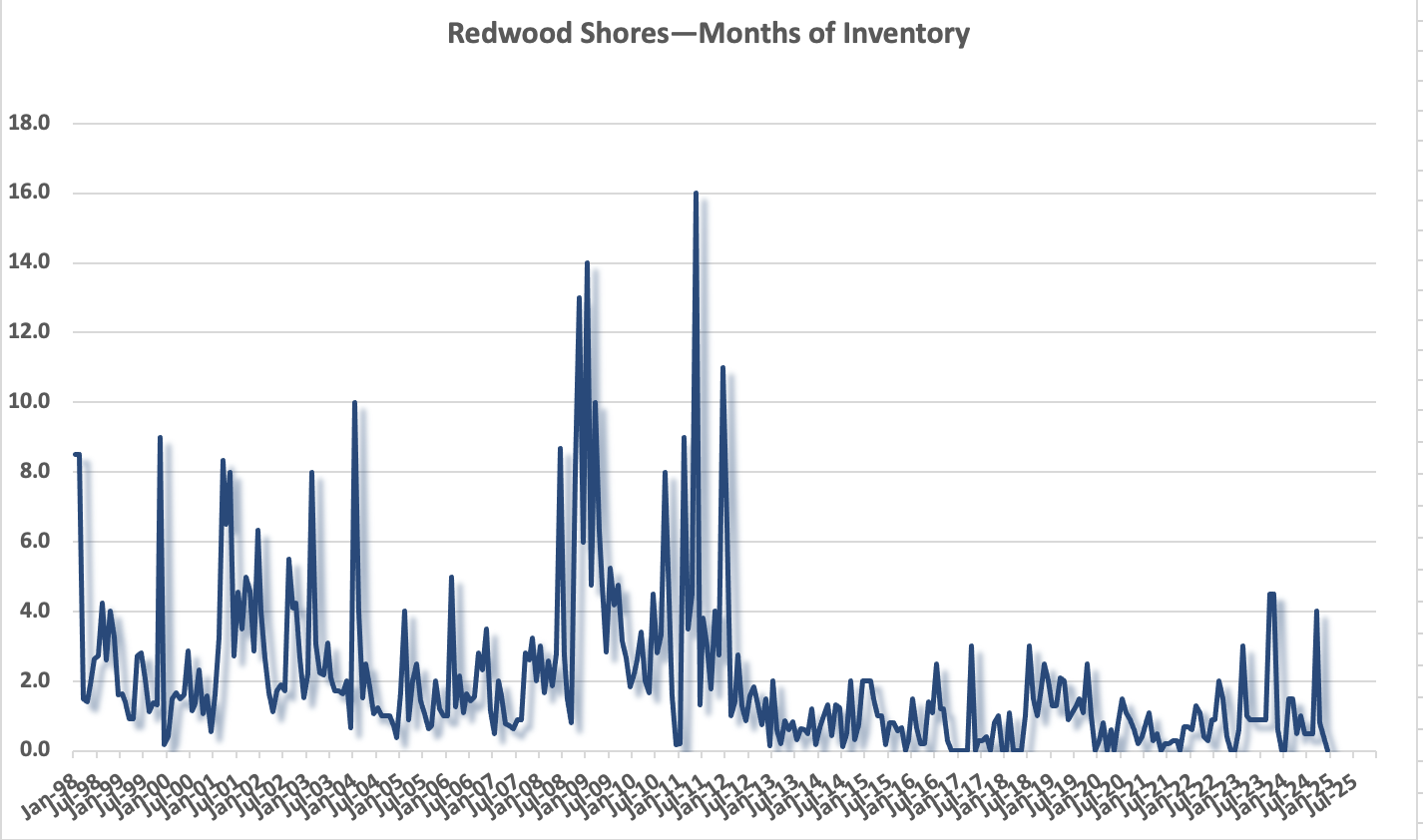

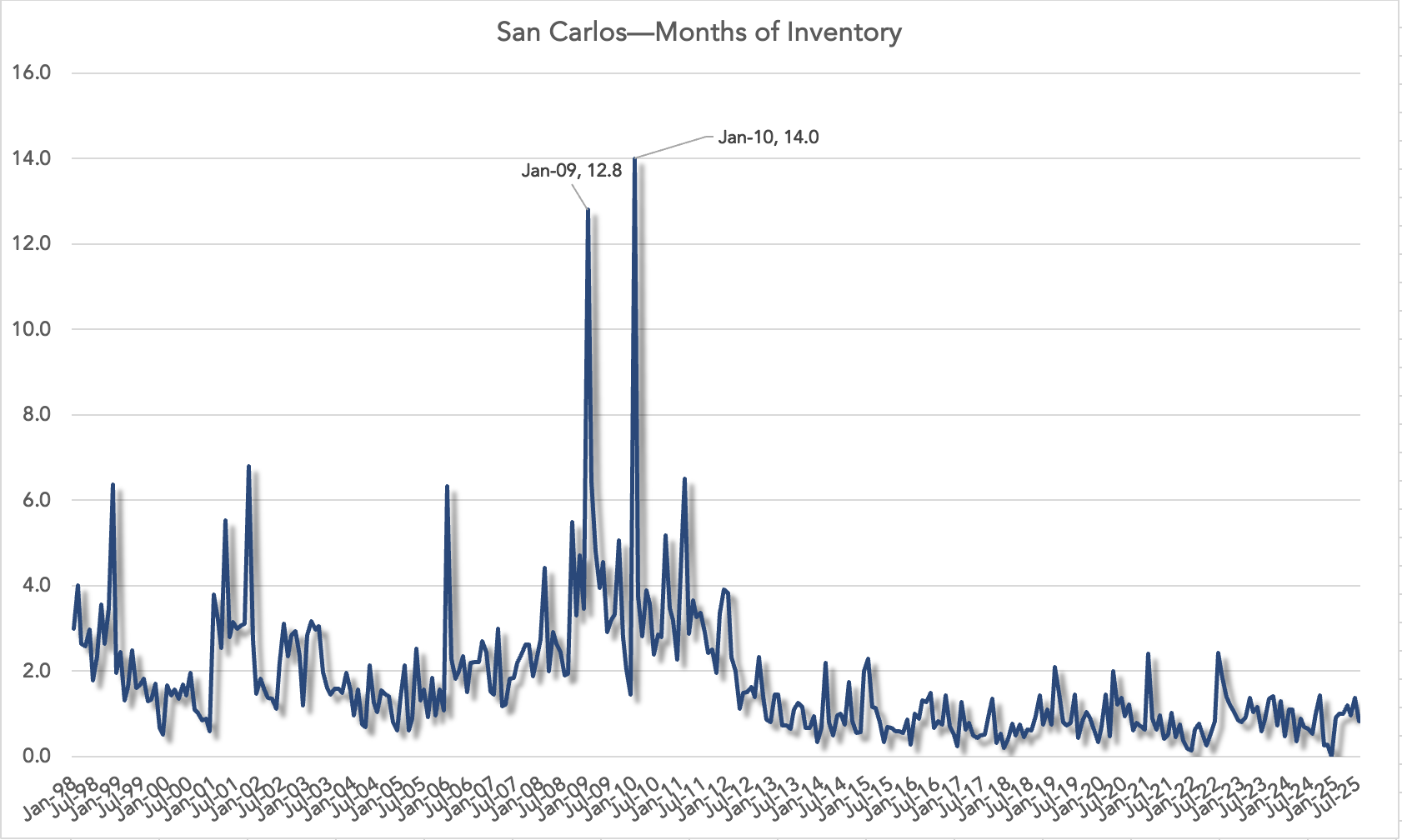

When interest rates began rising many speculative investments became less lucrative. As investors began selling off properties in droves, inventory grew and home values dropped.

The second shoe to drop:

Owner occupied homeowners also found themselves in difficult situations. Many had qualified for their loans based on a teaser start rate. Once the rates fully adjusted, they could no longer afford their home (the practice of qualifying people for a loan at the teaser start rates has been discontinued by every lending institution we know). Faced with lower values, many could not sell their home for what they owed. The result was an increase in foreclosures and short sales.

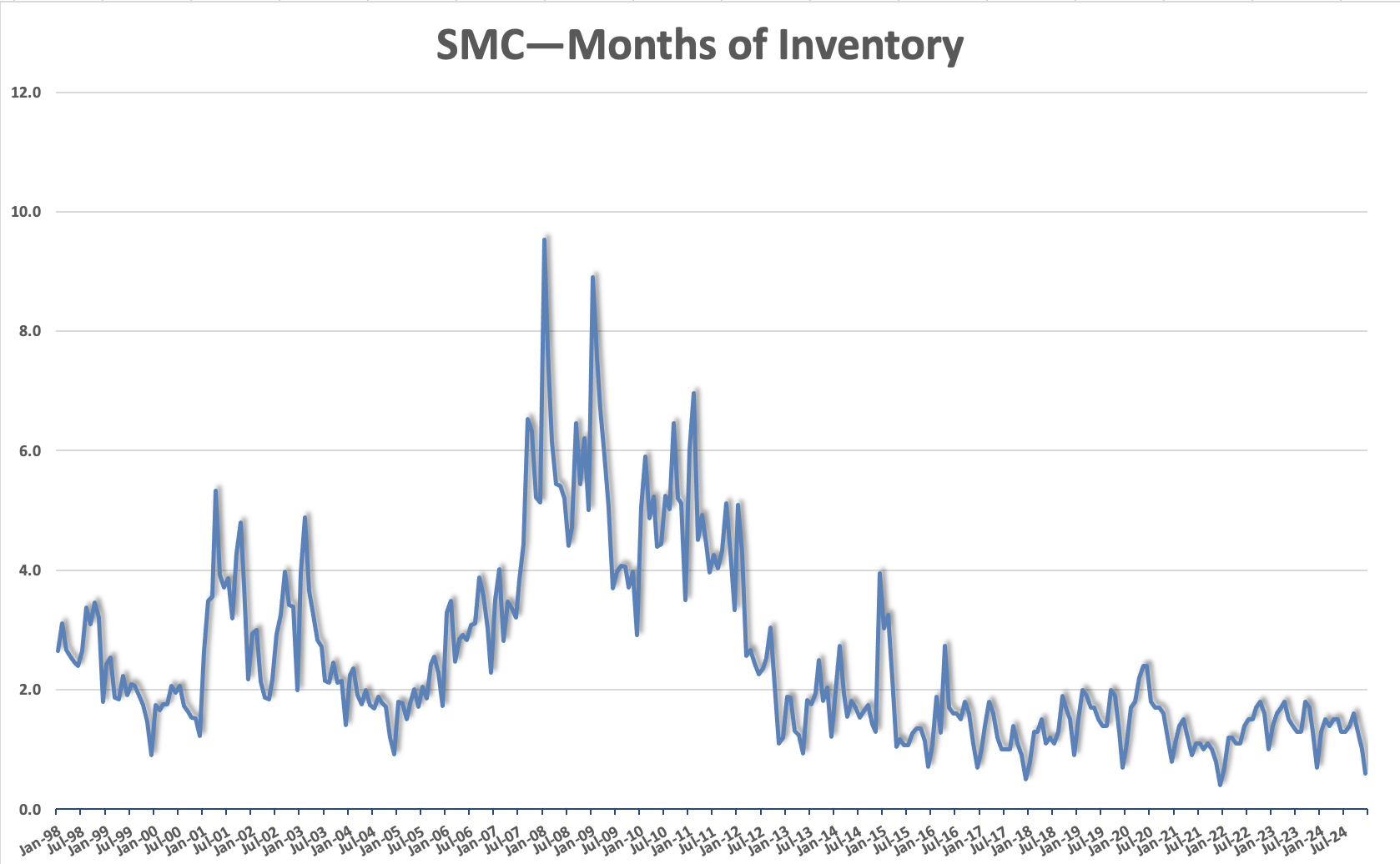

Both of these groups faced similar dilemma, as they could either no longer afford to own their home, or it no longer made financial sense. Forced with foreclosure, the need to sell, or the desire to liquidate, the market was flooded with the mortgage carnage crisis as evidenced by the staggering inventory levels.

Areas that were hit hard and will continue to see a downturn in values in 2008 have the following in common:

· Rampant growth spawned by increased demand

· Speculative ownership

· Over development of new housing projects

· Room for expansion into new developments and housing units

· An abundance of sub-prime loans

This is precisely why the Peninsula should fare better than other areas.

· There is little room for expansion

· Few new development has occurred in the past five years as compared to areas with growth potential

· High paying jobs are plentiful

· Low rate of speculative ownership

· Few sub-prime loans

Of course not to be overlooked or under appreciated is the desire to live in the technologically and culturally rich Bay Area.

However, it’s entirely possible we are on a precipice which could collapse at any time. What is impacting the Peninsula is the rising cost of energy–especially gasoline. What could have an incalculable impact would be a prolonged recession and loss of local jobs; either of these would undoubtedly bring a decrease in home values to the Peninsula. So much of the values in the Bay Area rely on the perception that it’s a great place to live. A natural disaster (such as a large earthquake) or terrorist attack would also have a detrimental economic effect on housing. Buyers who are sitting on the sideline and not availing themselves of the current conditions are essentially betting on any one of the former conditions manifesting in the near future.

Who’s buying a home right now? With appreciation levels essentially stalled for the time being, savvy investors will take advantage of other’s misfortunes and home buyers previously priced out of the market will seek opportunities in the less competitive market conditions.

When will these offers end? They’ll end when consumers return to more bullish spending patterns. When will that happen—of course no one knows. The only indication will be when you are no longer offered deferred or low interest finance rates and deep discounts—watch the ads.

When will these offers end? They’ll end when consumers return to more bullish spending patterns. When will that happen—of course no one knows. The only indication will be when you are no longer offered deferred or low interest finance rates and deep discounts—watch the ads.