Each year I post a new message on the anniversary of the “Shoot out at the OK Corralâ€, and also on Wyatt Earp’s birthday, March 19th (1848).

October 26th bears a lot of meaning for me. Most importantly it was the day my mother was born—and event without which this blog would not exist. My mother was a stall worth advocate of learning and the history that surrounds us. I fondly remember mornings when I would awake to find new message on our chalk-board in the kitchen that recounted some historical trivia—she was the first who said “What happened on this day in history?†It also marks the day of the famous shoot out near the OK Corral.

In 1992 I saw the movie “Tombstoneâ€, and I thought at the time, “What an interesting movie, I wonder what really happened?†That led me on a decade of research into the life and times of Wyatt Earp and the Wild West. Since then I have read every book I could get my hands on regarding the topic.

*Kurt Russell plays an excellent Wyatt Earp in the 1992 movie Tombstone.

In 1998 I had occasion to meet with several prominent authors of Wyatt Earp history. We met in Tombstone, Arizona for a trip to recount the facts and places that preceded the shootout as well as that which transpired after the events on that fateful October 26th day in 1881 when the Clanton’s, Mc Laury’s, the Earps and Doc Holliday had it out in proximity to the OK Corral.

The trip was enlightening to say the least, and as is often the case, finding the truth is more fascinating than the Hollywood fiction.

As you’ve probably gleamed the famous shoot out at the OK Corral never really happened at the OK Corral—it was around back in a vacant lot close to Fly’s photo gallery. But who fired the first shot? Those who know for sure are long gone but many believe it was Wyatt Earp—the only one to come out of the fray unscathed. Interesting enough one of the most important details omitted from every movie ever made was the trial that took place after the shootout which could have sent the Earp clan and Doc Holliday to the gallows. There were many witnesses to the gunfight that day and as you can imagine every one of them told a slightly different version of what happened. In December of that year the trial ended with the exoneration of the Earp’s and Holliday and with that the murder charges were dropped; but the acquittal set off a string of events including Virgil being crippled for life, the murder of Morgan Earp and the bloody massacre of the Clanton gang by Wyatt and his cronies.

For a good book to get a better understanding of the political environment which created the tension in this small silver mining town, I suggest you read a thesis now in book form written by Paul Mitchell Marks titled “And Die In The Westâ€, still in print at Amazon.com.

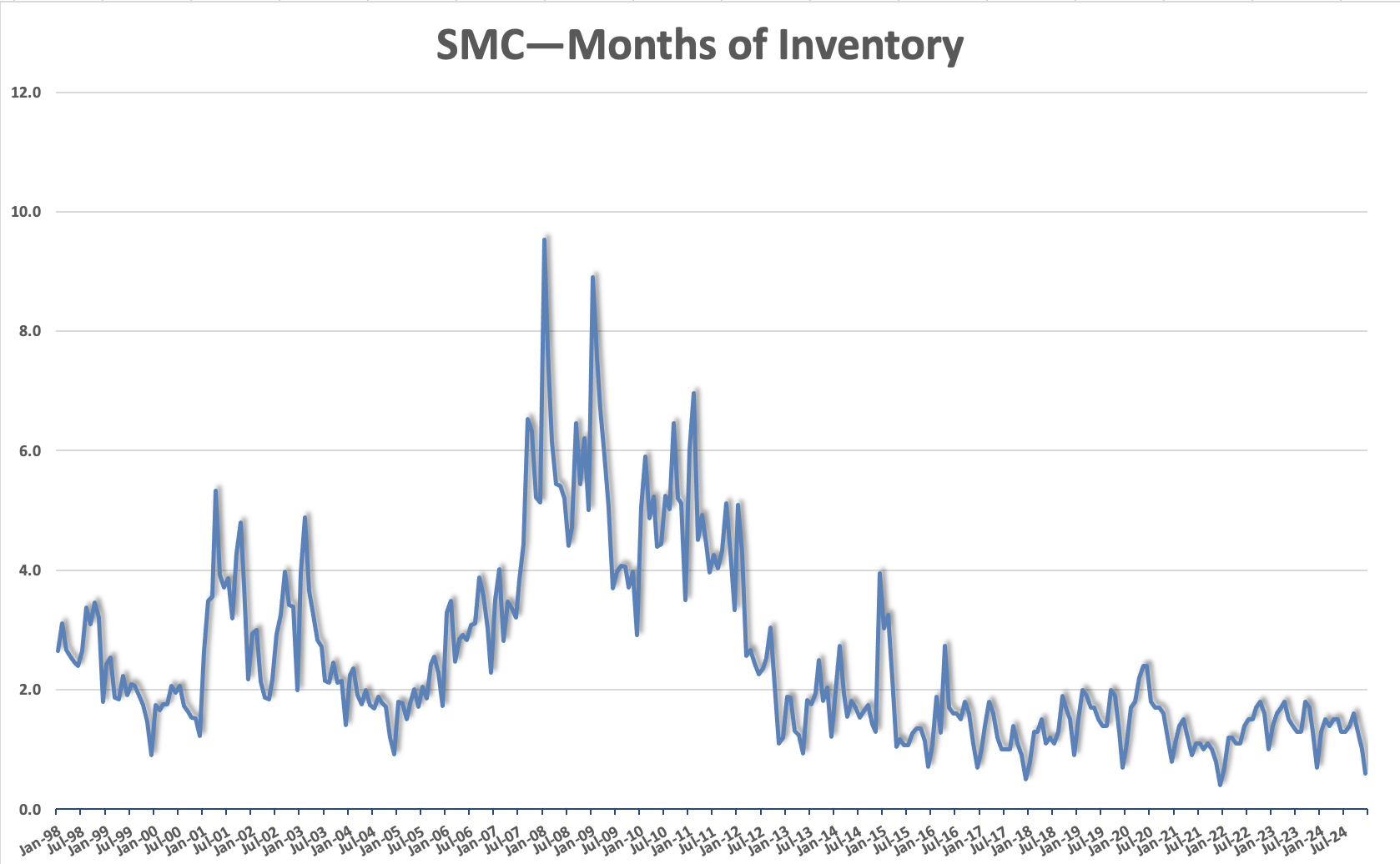

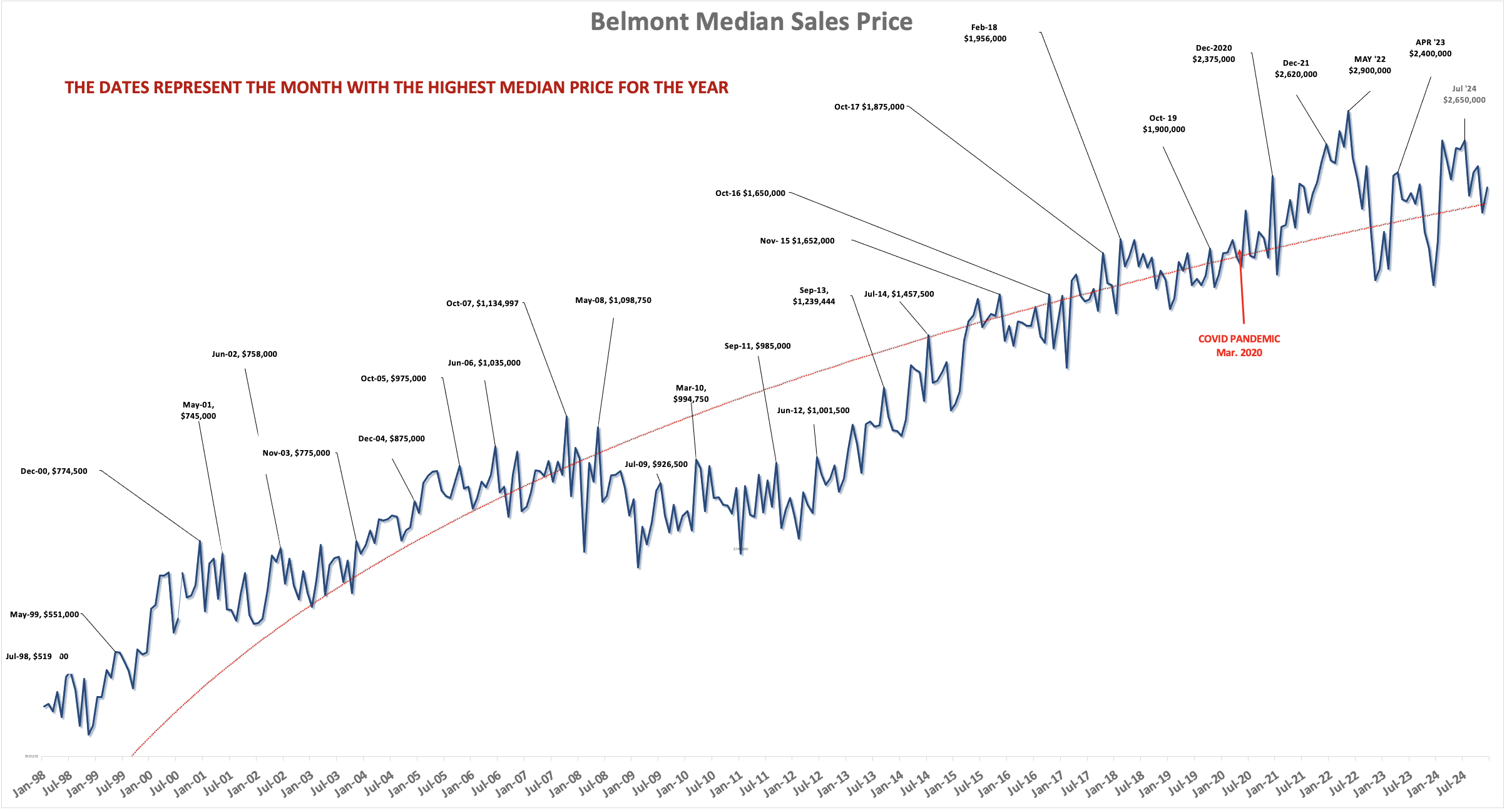

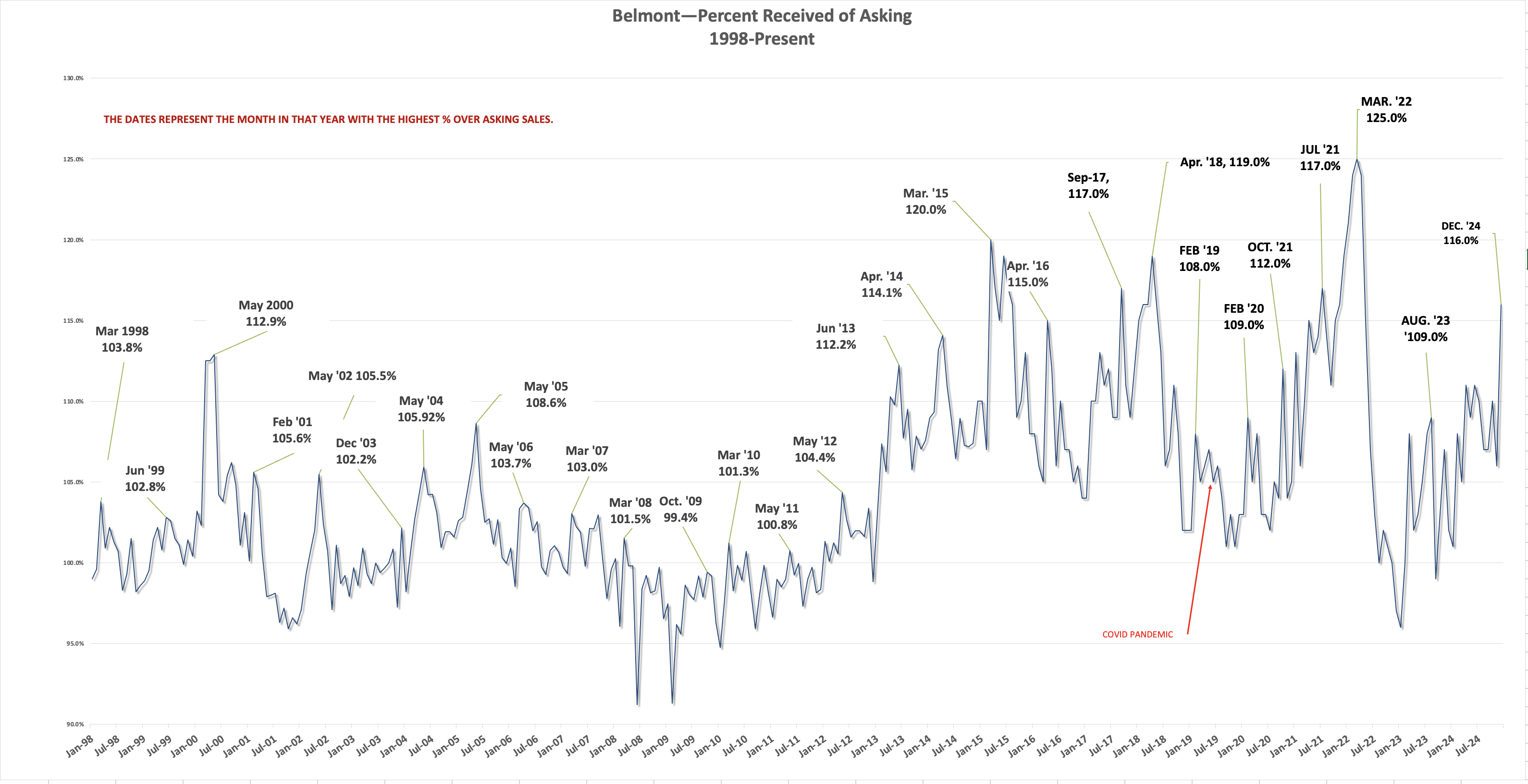

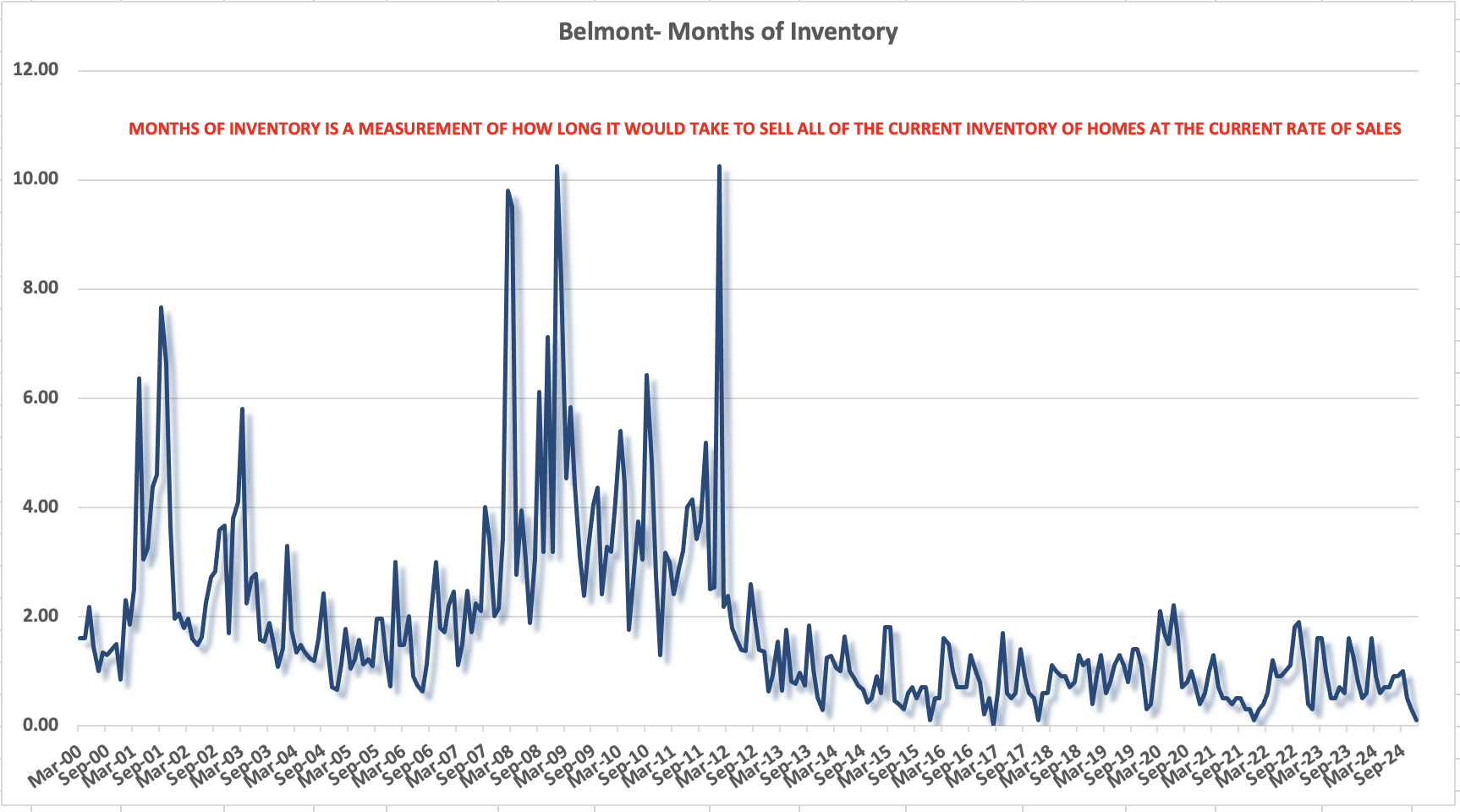

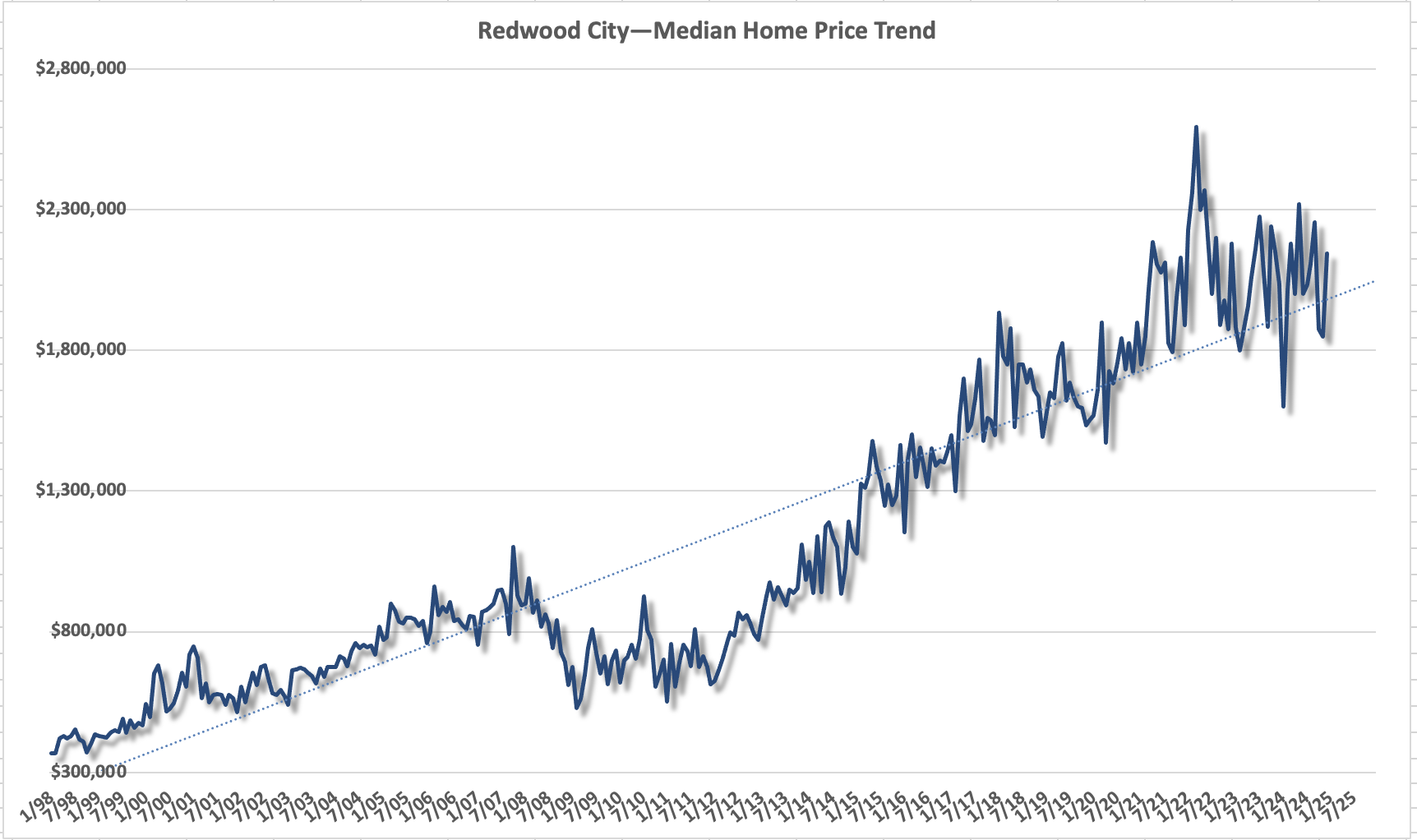

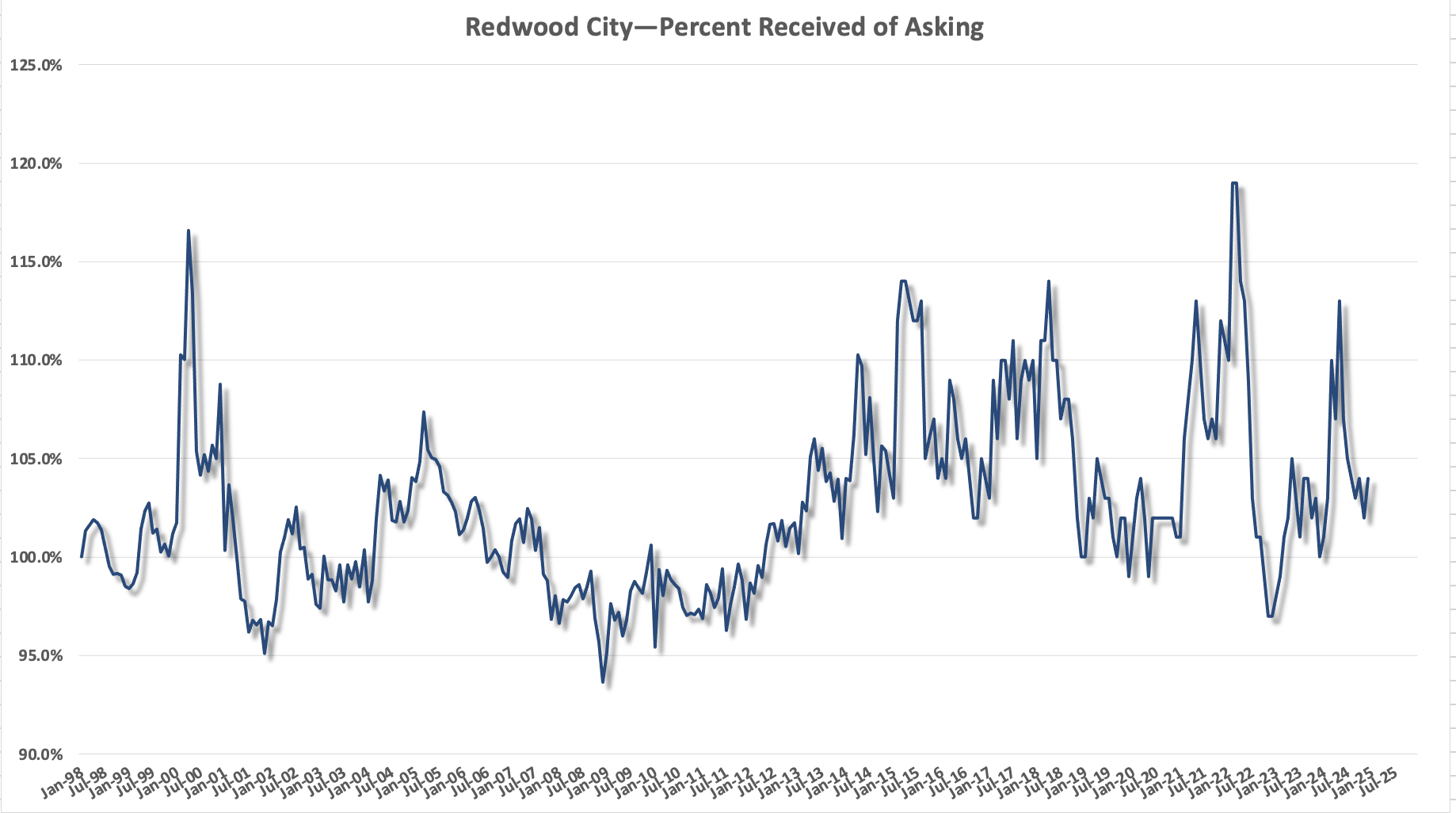

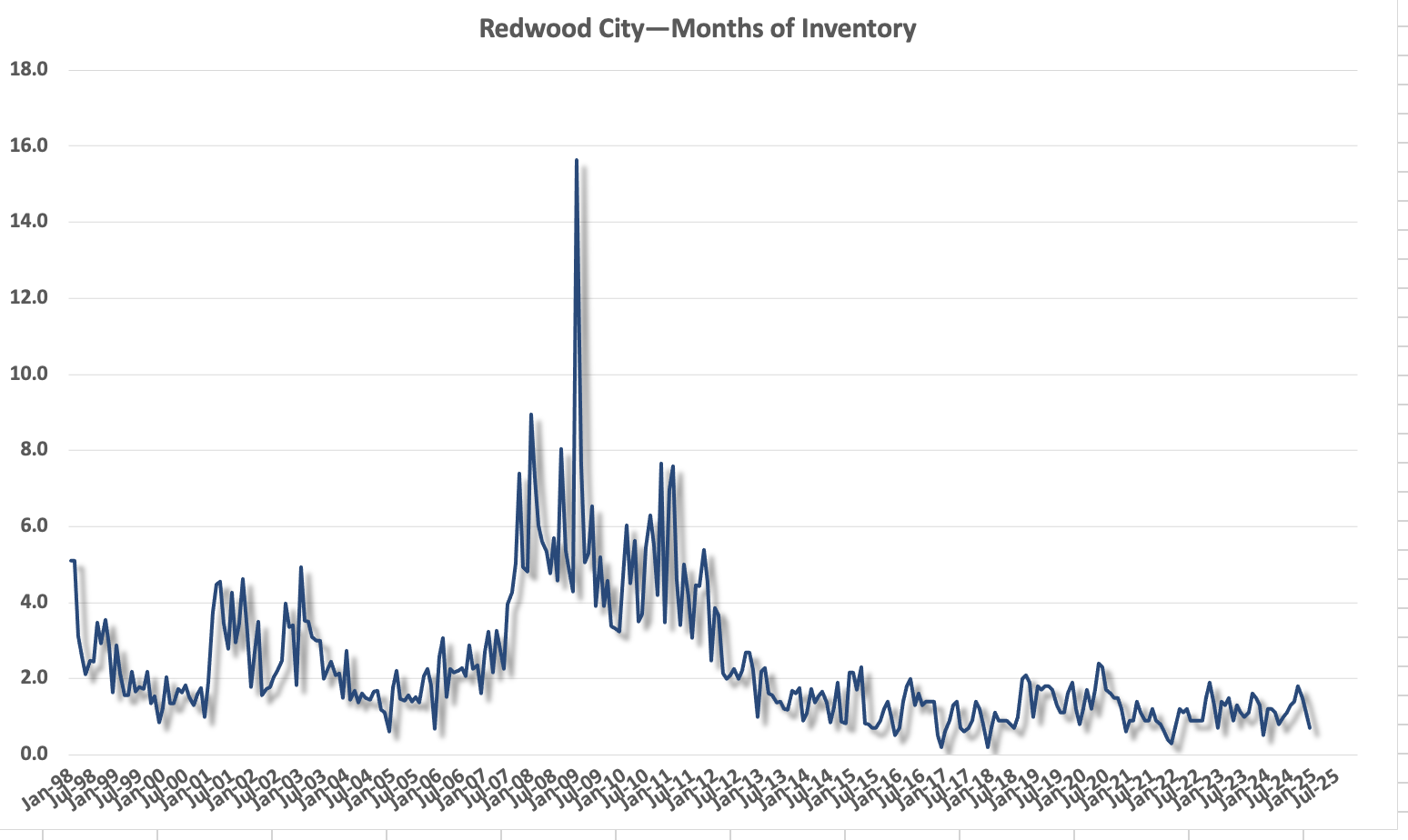

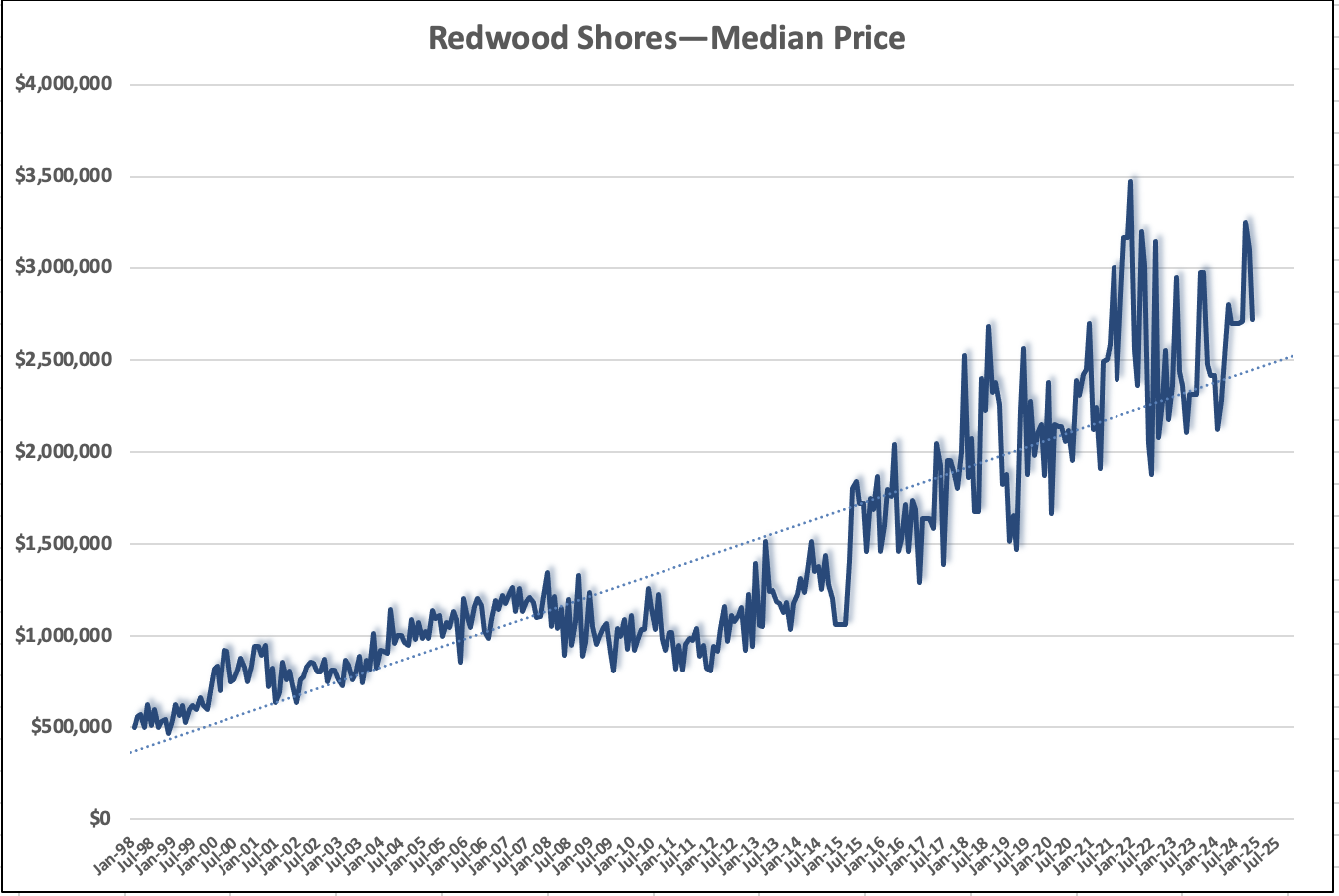

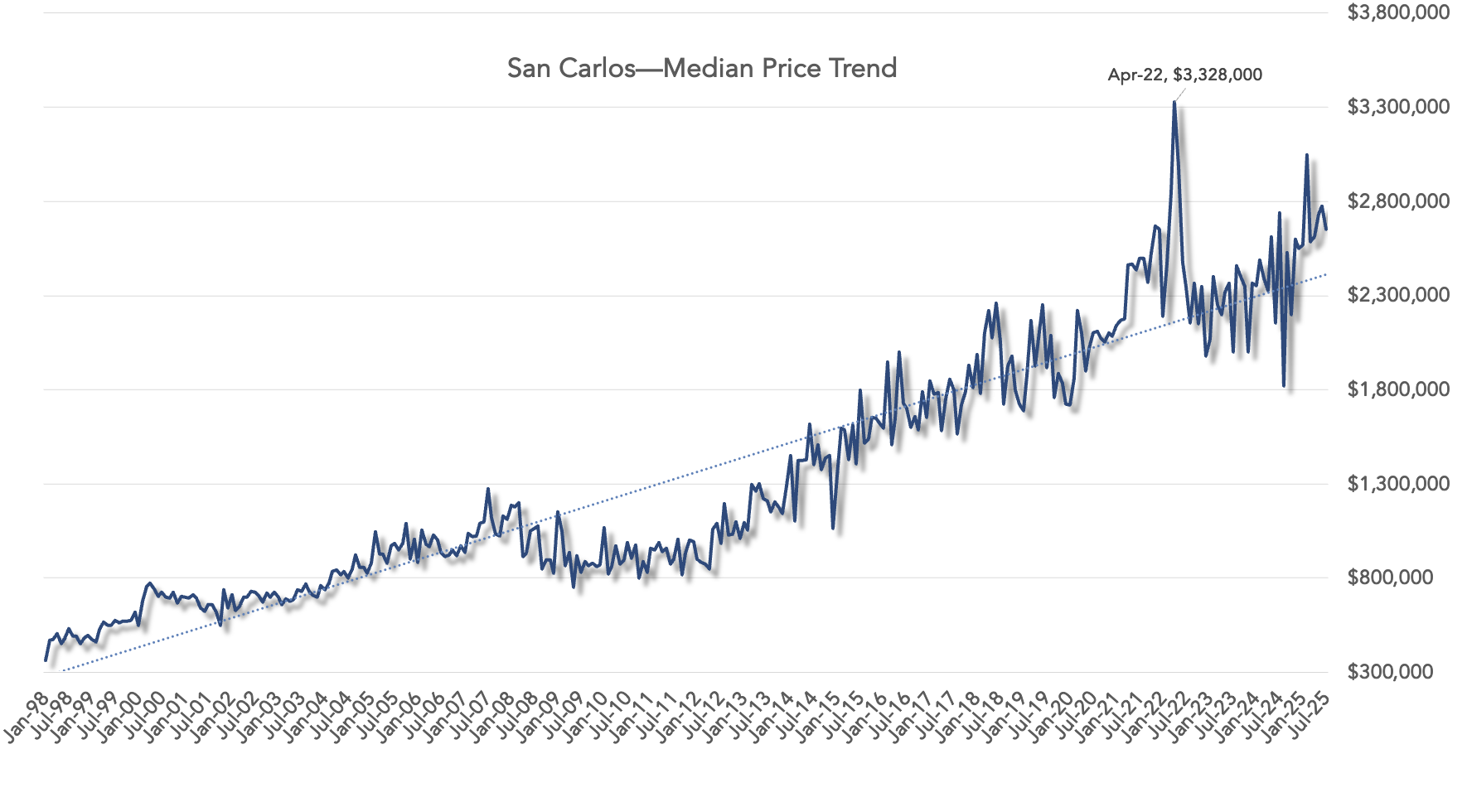

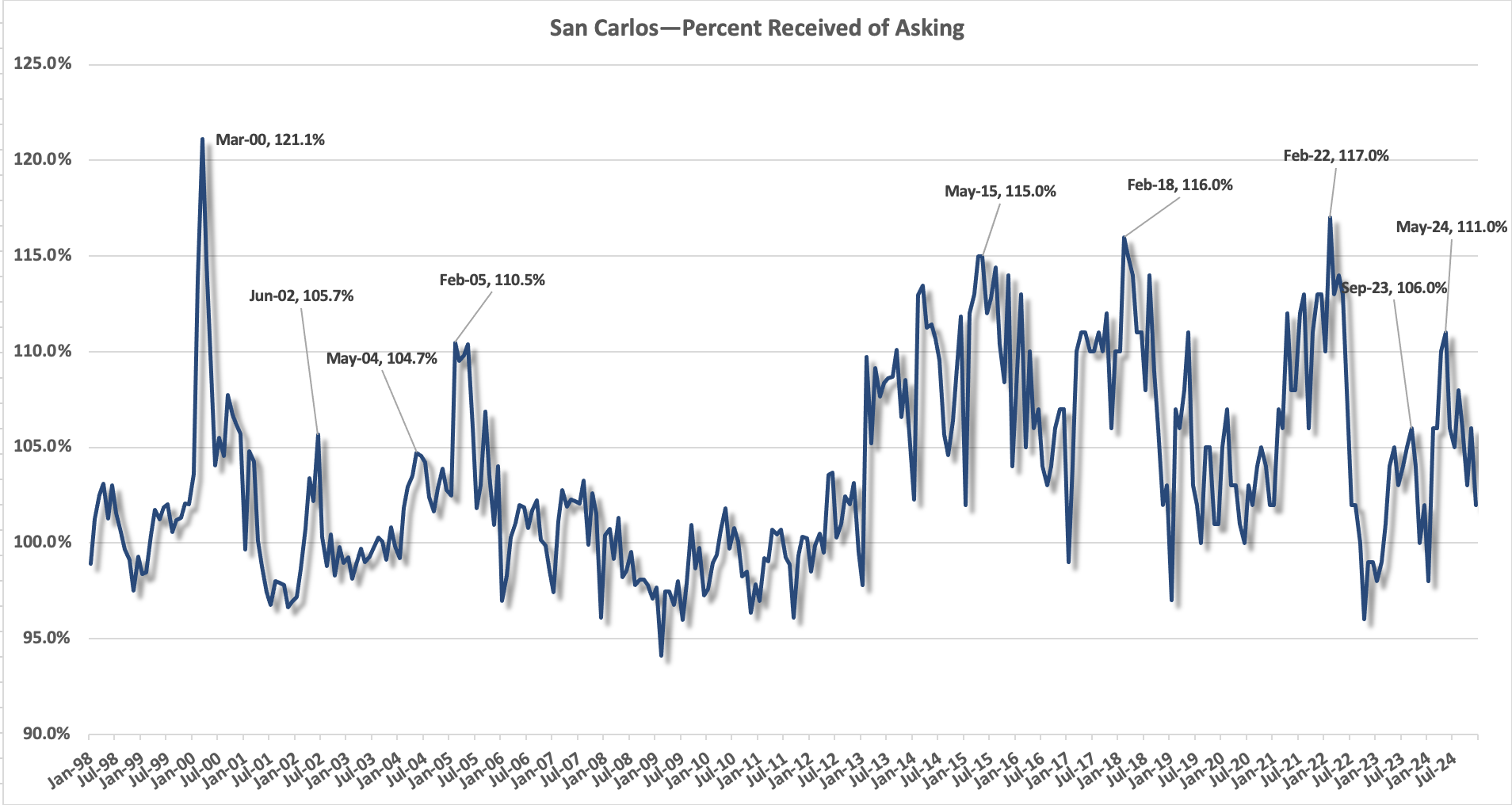

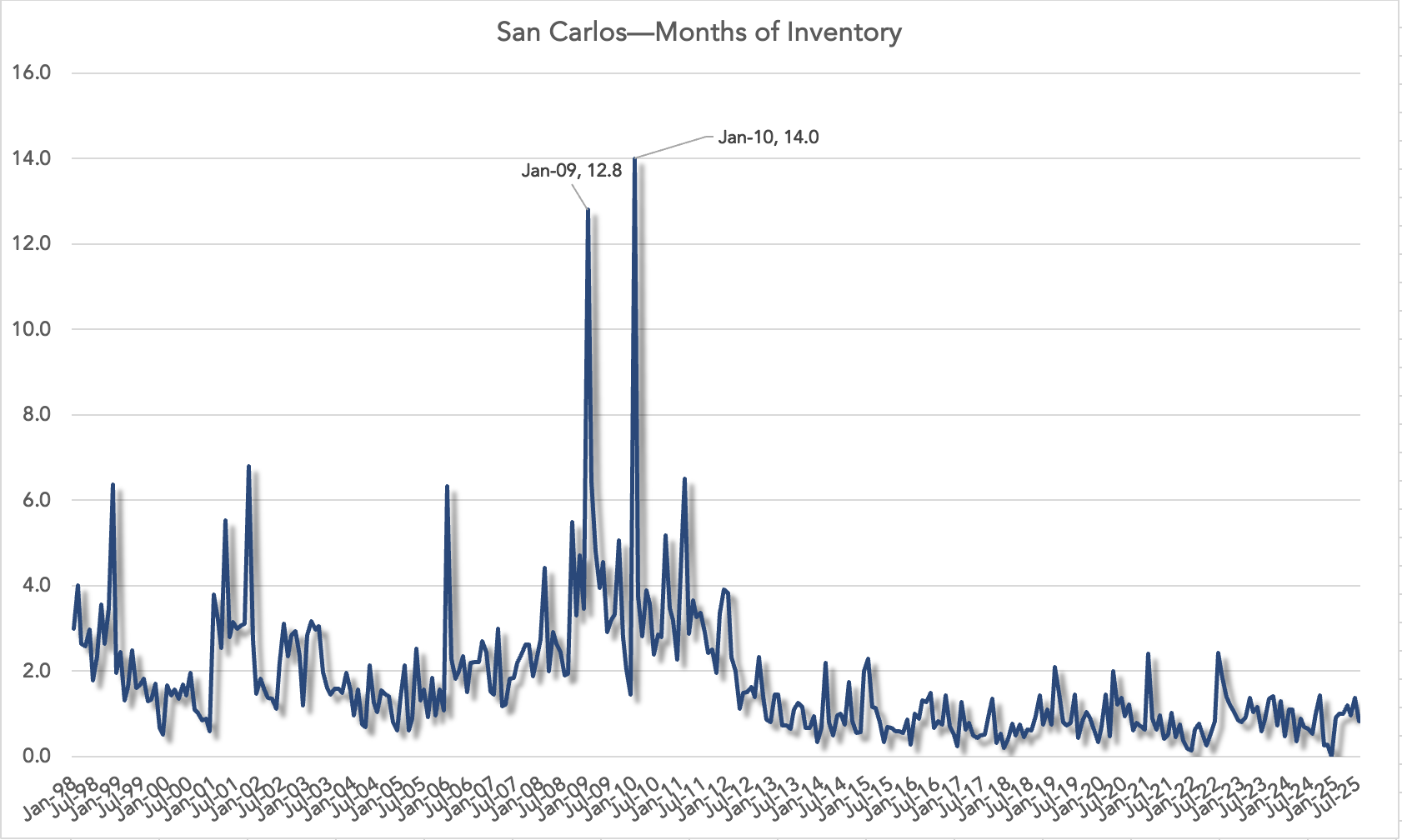

The San Francisco Peninsula market continues to outperform the country as a whole and even fairs better than San Francisco.

The San Francisco Peninsula market continues to outperform the country as a whole and even fairs better than San Francisco.