From Peaks to Plateaus: A 5-Year Look at Mid-Peninsula Home Values

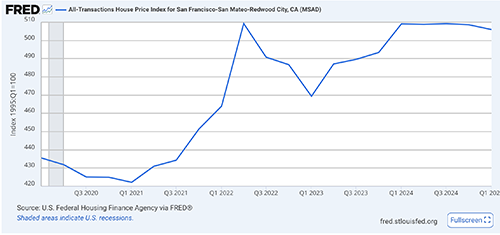

The Bay Area Mid-Peninsula housing market remains a focal point for both prospective buyers and sellers. In this analysis, we apply a data-driven approach to examine housing value trends from the onset of the COVID-19 pandemic to the present. This longitudinal perspective highlights fluctuations in market demand and corresponding value shifts.

At present, the market appears to be exhibiting a period of relative stability. However, future trajectories in home values throughout 2025 will likely be influenced by key external variables, including interest rate movements and prevailing consumer sentiment.

📈 Trend Summary:

- 2020 to Early 2021:

Prices were fairly flat to slightly declining, bottoming at 422.18 in Q1 2021. - Mid 2021 to Q2 2022:

Strong upward momentum — the index rose from 430.97 to a peak of 509.27 in April 2022, likely reflecting post-pandemic demand, low interest rates, and migration shifts. - Q3 2022 to Q1 2023:

Correction phase — the index dipped to 469.38, roughly an 8% decline, likely due to inflation fears and rising mortgage rates. - Q2 2023 to Q1 2024:

Recovery trend — regained momentum, gradually climbing back to around 509.07 by January 2024. - Most Recent (2024 to Q1 2025):

Stabilization — hovering just above 508, with a slight downtick to 505.95 by January 2025. This suggests a plateau in prices, possibly indicating market equilibrium or buyer fatigue at current price levels.

📊 Key Observations:

- Peak Index: 509.27 (April 2022) — prices have since oscillated just below this level, indicating a resilient but mature market.

- Recovery Strength: Prices rebounded well after the 2022–2023 dip, signaling strong underlying demand.

- Flatline in 2024: Minimal change throughout the year implies a wait-and-see attitude among buyers/sellers, likely tied to interest rate expectations or economic uncertainty.

🧭 Implications for Strategy:

- For Sellers: We’re near historic price highs. If rates remain stable, pricing slightly below peak comps could attract strong offers.

- For Buyers: While prices aren’t dropping, there’s less upward pressure now — negotiating leverage may be improving.

- For Appraisal/Valuation: Use mid-2022 or early 2024 comparables carefully — they represent market peaks and may not reflect current buyer tolerance unless demand surges again.

Drew and Christine Morgan are experienced REALTORS and NOTARY PUBLIC located in Belmont, CA, where they own and operate MORGANHOMES, Inc. They have assisted buyers and sellers in their community for over 30 years. Drew and Christine have received the coveted Diamond award and ranked among the top 50 agents nationwide and the top 3 in Northern California by RE/MAX. To contact them, please call (650) 508.1441 or emailinfo@morganhomes.com.

For all you need to know about Belmont, subscribe to this blog right here. You can also follow us on Facebook and on Twitter.

This article provides educational information and is intended for informational purposes only. It should not be considered real estate, tax, insurance, or legal advice; it cannot replace advice tailored to your situation. It’s always best to seek guidance from a professional familiar with your scenario.

BROKER | MANAGER | NOTARY